Six years later, Ant Group, its parent company, unveiled the integration of Alipay+ into all 7-Eleven stores in Malaysia.Source: Alipay+

Ant Group enables Alipay+ in all 7-Eleven stores in Malaysia

- Alipay+ will be integrated into over 2,400 7-Eleven stores in Malaysia.

- Alipay+ is now at more than 80,000 merchant touchpoints all over Malaysia.

In 2016, convenience store chain 7-Eleven Malaysia became the first retailer in Malaysia to start accepting Alipay mobile wallets as a payment method. The aim at that point was to attract more Chinese tourists to shop at the convenience store chain across the country. Six years later, Ant Group, its parent company, unveiled the integration of Alipay+ into all 7-Eleven stores in Malaysia.

Unlike Alipay, Alipay+ is not a mobile wallet or banking app. Instead, Alipay+ partners with acquirers and payment service providers to connect merchants with consumers using multiple digital payment methods. Ant Group, with the help of Razer Merchant Services, “is facilitating the integration of Alipay+ in over 2,400 7-Eleven stores in Malaysia,” Alipay said in a statement.

What will Alipay+ offer to all 7-Eleven stores in Malaysia?

Payment using Alipay in Sabah, Malaysia.

Source: Shutterstock

While the move to enable the usage of the Alipay mobile wallet in all 7-Eleven stores in Malaysia six years ago was a means to attract Chinese tourists, the action by Ant Group, this time, is to provide a seamless and convenient digital payment solution for visitors from around the world.

That also means “Users of four leading Asian mobile wallets including AlipayHK (Hong Kong SAR), GCash (Philippines), Kakao Pay (South Korea) and TrueMoney (Thailand) can now seamlessly pay in 7-Eleven using their home mobile wallets,” the statement reads.

Ant Group introduced Alipay+ in 2020 to enable businesses, especially small and medium-sized enterprises, to process a wide range of mobile payment methods and reach more than one billion regional and global consumers.

With the latest development and acceptance in 7-Eleven, Alipay+ has now integrated into more than 80,000 merchant touchpoints in Malaysia alone. “These merchants comprise a wide range of industries such as retail, F&B, and hospitality, including well-known local and international brands like Tealive, MyNEWS, Sephora, Watsons, Sports Direct, and Duty-Free stores,” Ant Group noted.

That said, the acceptance of Alipay+ will offer Asian travelers a more convenient digital travel experience and comes as Malaysia looks to welcome more tourists. Cherry Huang, General Manager of Alipay+ Offline Merchant Services at Ant Group, also noted that the company plans to “continue to enable more local merchants to integrate Alipay and promote a positive digital ecosystem between partners, businesses, and travelers.”

AliPay+ gradual dominance of Southeast Asia

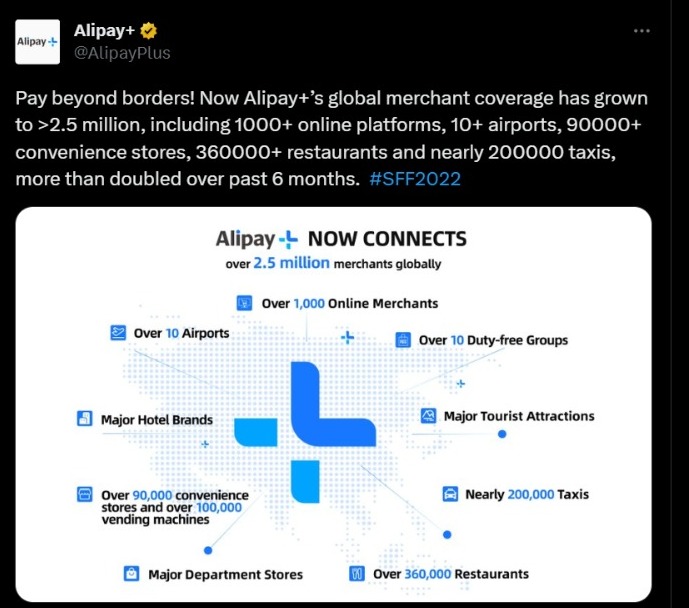

As of November 2022. Alipay+’s global merchant coverage has more than doubled over the past six months to over 2.5 million.

Source: Alipay+ Twitter

Since last year, Alipay+ has been making steady progress in markets including Southeast Asia, South Korea, and Japan, connecting local and regional merchants with various digital payment methods. The goal is to make Alipay+ reduce interoperability hiccups in the fragmented Southeast Asia payments ecosystem.

The idea is when a merchant installs Alipay+. The merchant’s customers can pay for goods and services with any of the participating wallets in the ecosystem instead of having to ensure operability with the wallets one by one. So, the more wallets in the ecosystem, the more attractive the value proposition becomes.

Moreover, given the lack of consolidation in Southeast Asia’s e-wallets market, Ant is offering a solution that circumvents the headache that fragmentation creates for merchants.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications