Curlec by Razorpay revolutionizes the digital payments landscape in Malaysia. (Source – Shutterstock)

How Curlec and Razorpay are pioneering Malaysia’s digital payments landscape

- Backed by Razorpay India, Curlec seeks to merge local and international payment interfaces.

- Aiming for an RM10 billion GTV in Malaysia by end-2025.

- Curlec pioneers offering a range of e-commerce payment options, including online direct debits.

Online banking and digital payments have dramatically shifted consumers’ purchasing behaviors and the way businesses operate, leading to a revolution in the e-commerce and banking sectors. This is especially apparent in Malaysia, where online businesses have experienced consistent growth over time. Consequently, it has become increasingly crucial for merchants to strengthen their online presence and select the most suitable payment gateways for their operations.

Recently, Curlec, a native Malaysian fintech firm, transformed into a comprehensive payment gateway suitable for businesses of all sizes, following its acquisition by Indian Fintech Unicorn, Razorpay, last year.

Curlec, now under the banner of Razorpay, combines the technological excellence from India with a profound understanding of the Malaysian payments landscape. Its goal is to provide businesses with a holistic payment gateway that not only facilitates payments and automates payouts, but also enables them to concentrate on their customers. Leveraging Razorpay’s technology, which currently serves 10 million businesses in India, the newly unveiled Curlec Payment Gateway promises to offer an unparalleled payment experience to Malaysian merchants.

Changing the digital payments landscape in Malaysia

Aiming to serve over 5,000 businesses and achieve an annual Gross Transaction Value (GTV) of RM10 billion by 2025, the growth of the Curlec Payment Gateway is anticipated to be powered by Malaysia’s rapidly burgeoning digital economy. Factors propelling this expansion include high mobile phone usage and robust government backing for digital transformation.

Moreover, Malaysia’s DuitNow real-time payments system serves as a significant catalyst for merchants to adopt cashless payments, further boosting mobile transactions. Given the swift economic development in Malaysia and Southeast Asia, the need for more robust, reliable, and technologically advanced payment solutions is apparent.

Relying on Razorpay India’s pioneering solutions and capitalizing on its vast experience across various sectors, Curlec plans to integrate the same innovative technologies that have been successful in the Indian market.

Reflecting on the global premiere of its Payment Gateway, Shashank Kumar, the Managing Director and Co-Founder of Razorpay, expressed the company’s enthusiasm about initiating their first international payment gateway in Malaysia, identifying the immense potential in the Southeast Asian region.

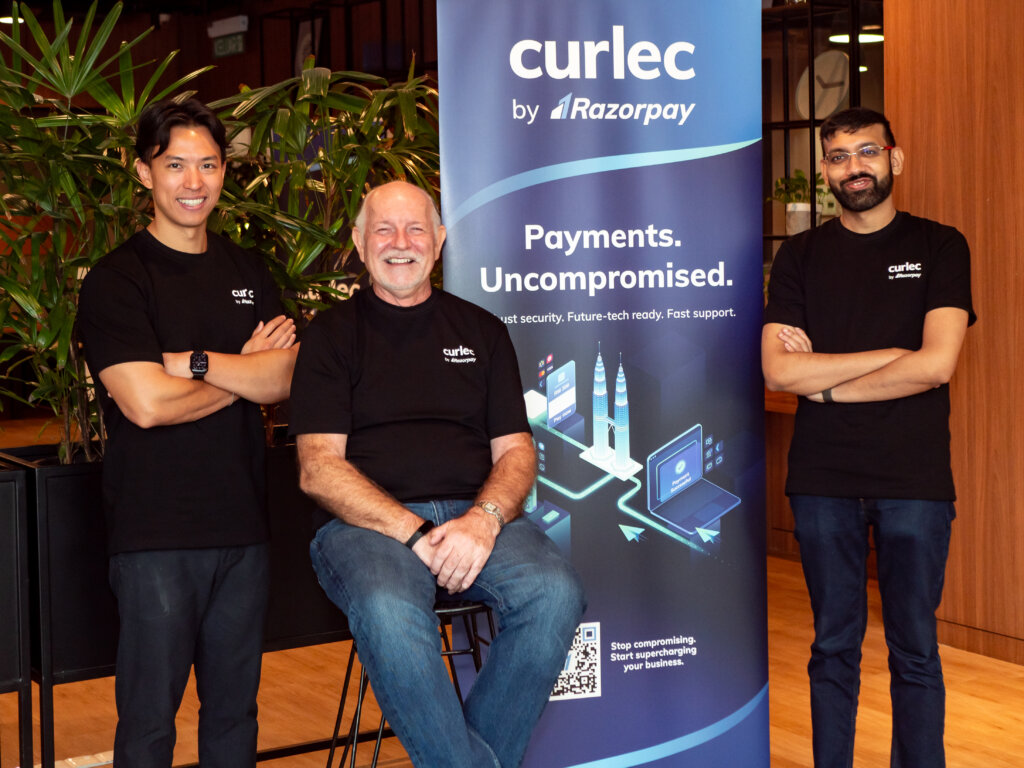

From left: Zac Liew, Co-Founder & Chief Executive Officer, Curlec; Steve Kucia, Co-Founder & Chairman, Curlec; Shashank Kumar, Co-Founder & Managing Director, Razorpay

Kumar underscored the significance of payments in Malaysia, emphasizing its substantial role across all business scales and sectors. He proposed that Razorpay’s considerable experience in handling India’s multifaceted and dynamic market has positioned them well for international expansion.

“When we joined forces with Curlec a year ago, our vision was to build products that cater to the needs of Southeast Asian users. The unveiling of the new Curlec Payment Gateway today is a first step in that direction,” he stated.

Kumar conveyed his belief that the new payment gateway would trigger a transformative shift in the transactional dynamics between Malaysian businesses and consumers. He also affirmed his conviction that the pillars of collaboration, innovation, and customer-centricity would be instrumental in maximizing the potential of digital payments and driving Malaysia’s economic progress.

Why is this intriguing?

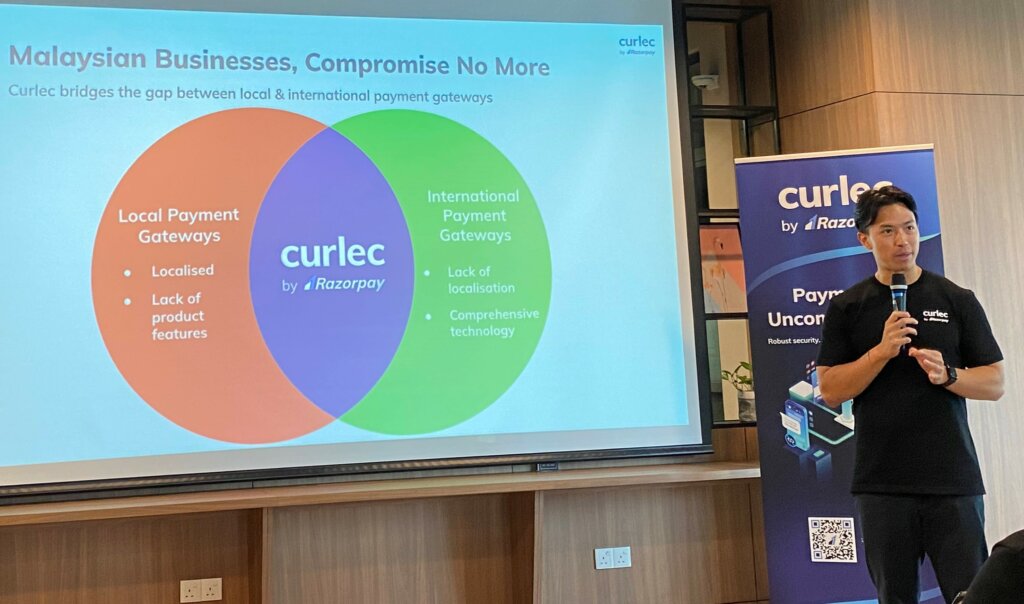

In the Malaysian market, a spectrum of companies exists, from local payment firms and banks that offer services but lack technological sophistication, to international, regional, and global companies equipped with high-end technology and products but lacking local adaptations.

“Curlec stands out by bridging this gap,” said Zac Liew, Co-Founder & CEO of Curlec by Razorpay. “Consumers can use their preferred payment method without compromises, and businesses are no longer torn between choosing local payment gateways or international options with drawbacks in technology or localization. Curlec blends cutting-edge Indian technology with local knowledge and support, providing the best of both worlds.”

Zac Liew, Co-Founder & CEO of Curlec by Razorpay, highlights what differentiates them from others.

When it comes to payments, Curlec adheres to a four-pronged commitment – technology, payments, support, and security, without compromises.

Curlec incorporates, as Liew described, “world-class” technology, including a streamlined one-click checkout experience and an intuitive user interface. It also offers easy-to-use no-code applications for digital novices, simplifying the process of setting up online stores and payments.

Unlike some international players who provide only surface-level transactions, Curlec aims for deep integration into the domestic banking system, thereby becoming a truly local player.

Liew noted that Curlec is the market’s first payments company to offer a comprehensive range of e-commerce payment options, such as FPX, e-wallet, credit cards, and uniquely, online direct debits through its gateway. Their commitment to comprehensive local payment solutions remains unwavering.

Furthermore, Curlec prides itself on having a dedicated team of 50 Malaysians ready to serve local businesses and consumers. As the only international player offering this level of localized support, they show an uncompromised commitment to local assistance.

Security and privacy form the cornerstone of Curlec’s operations. Its proprietary technology prioritizes security, encompassing fraud detection tools, anti-money laundering measures, and efficient KYC processes, all designed for scalability.

As Liew stated, “When you combine these four elements, Malaysian businesses, and consumers can rest assured they won’t have to compromise on anything when it comes to payment acceptance or money transfer.”

The strategic partnership between Curlec and Razorpay aims to proactively address potential regulatory challenges in the digital payment landscape. “With our impending entry into the market, we are committed to fully complying with Bank Negara regulations. We have several more announcements to make in the coming months, particularly on that front. It’s safe to say that we aim to go beyond mere compliance, striving to exceed expectations, especially with the deployment of advanced security tools,” stated Liew.

Liew also hinted at the company’s plans for substantial investment in this market, focusing predominantly on domestic payment rails. While he refrained from disclosing too many details at this stage, he reassured that Curlec would provide more information about their regulatory approach and domestic banking strategies in the coming months. He concluded by stating that more updates are on the horizon.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications