Are Local Currency Accounts Key to International eCommerce Expansion?

The e-commerce landscape is fiercely competitive, and businesses face the challenge of cheaper brands encroaching on their market share, prompting the need for strategic decisions. One potential countermove is to lower prices, but this can lead to a race to the bottom. Profit margins can shrink, and businesses might struggle to maintain the quality of their products and services.

Another option is to add new products to help attract a wider customer base and grow the market share. However, this strategy can strain resources and even dilute the brand identity if not executed carefully. Additionally, it may take time for these new products to gain traction and contribute to the bottom line, which could impact short-term financial results.

One promising growth strategy is international expansion, as it allows e-commerce businesses to tap into new markets and diversify their revenue streams without immediately resorting to price wars or stretching resources too thin. Yet this path is not without obstacles, including currency fluctuations, complex regulations, and evolving payment trends. To navigate these effectively, e-commerce businesses can leverage purpose-built tools like overseas or local currency accounts. While this may seem a minor detail, having access to these accounts when venturing into international expansion can directly impact profitability.

The stagnation of e-commerce

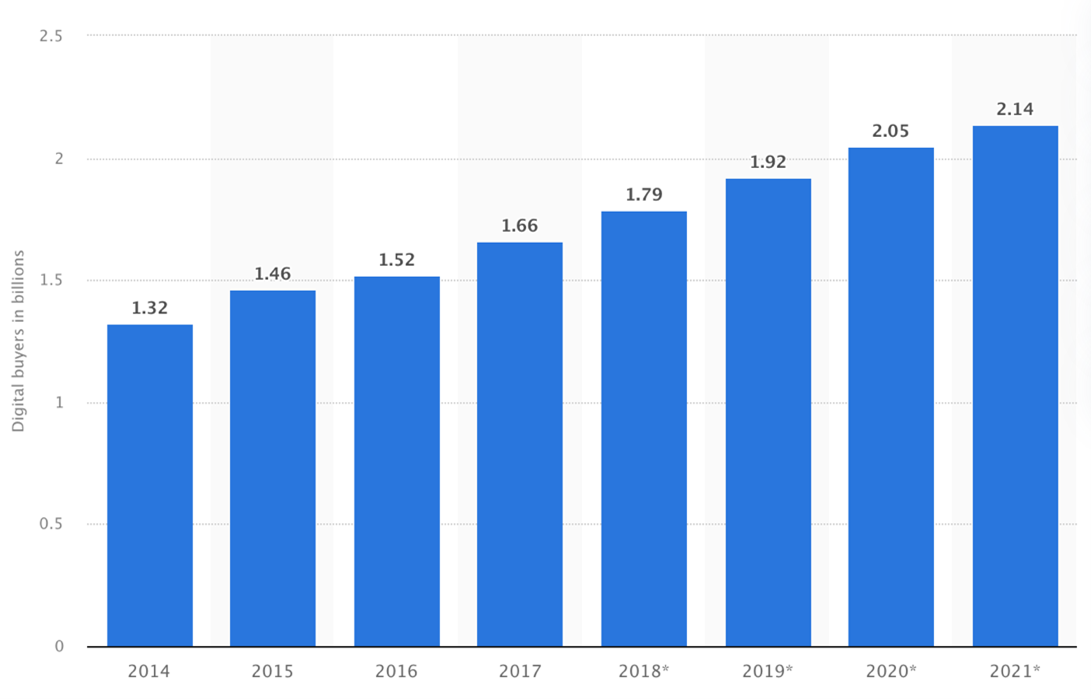

The e-commerce industry has famously been one of exceptional growth since the mid-1990s, corresponding with the launch of giants like Amazon and Alibaba. The demand for more convenient shopping experiences and technological advancements propelled this boom, transforming how consumers make purchases and businesses operate. In 2021, 2.14 billion people shopped online – about 28 per cent of the world’s population – compared to 1.32 billion in 2014. However, more recently, the seemingly exponential curve of sales has flattened. Customers are becoming more frugal due to inflation – two-thirds of respondents to the US Consumer Pulse Survey 2023 said it was one of their top three worries – causing the industry’s growth to stagnate.

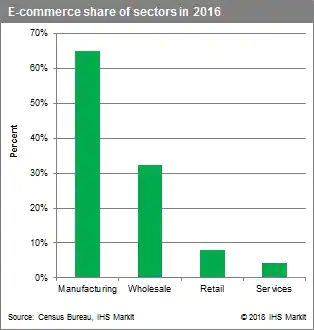

The growth of e-commerce retail sales has outpaced that of the wholesale and manufacturing sectors for 12 of the 14 years leading up to 2016. Source: SPG Global

Number of digital buyers worldwide in billions from 2014 to 2021. Source: Statista

While established e-commerce platforms with global customer bases may be able to weather a drop in sales, the same cannot be said for small and medium businesses. Inflated operating costs, like raw materials, shipping, and labor, will also erode profit margins and have a negative impact. Smaller businesses often operate on tight budgets, so any cost increase can hit profitability hard. Retailers that rely on imported goods may also be overly affected as foreign currency can depreciate in times of inflation. For example, just before Sterling dropped to a record low last year, the cost of imported goods increased by 5 per cent.

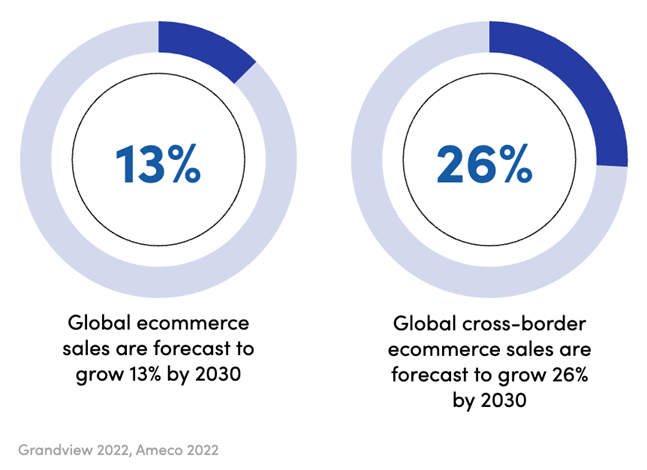

In challenging economic conditions, smaller e-commerce businesses may want to investigate expanding internationally to increase their customer base. Global cross-border e-commerce sales are forecast to grow twice as fast as global e-commerce sales in general over the next seven years. Thanks, in part, to the rise of convenient and secure digital payment methods, consumers are more comfortable buying goods online from anywhere. They also expect access to a broader range of products to be available for purchase at any time they choose.

Global cross-border e-commerce sales are forecast to grow twice as fast as global e-commerce sales in general over the next seven years. Source: Raconteur/Grandview/Ameco

According to a 2022 report from IPC, 83 percent of regular online shoppers do so at least once a month.

International expansion: The challenges

However, this is not a risk-free solution for retailers. Currency fluctuations can significantly impact pricing, profit margins, and overall financial stability. Conducting business overseas also involves navigating complex regulatory compliance issues.

Trade rules and regulations vary considerably from one country to another, touching everything from import and export procedures to product labelling and safety standards. Environmental compliance can be similarly complex, including restrictions on packaging materials, waste disposal, and carbon footprints associated with shipping.

It is imperative that e-commerce businesses expanding internationally stay up-to-date with these regulations and ensure that their operations comply, as failure to do so can result in delays, fines, or even legal consequences. In 2022, over $2bn of fines relating to anti-money laundering (AML) compliance in banking were administered globally. AML checks are often associated with international payments because they present a higher risk due to the complexity and cross-border nature of such transactions.

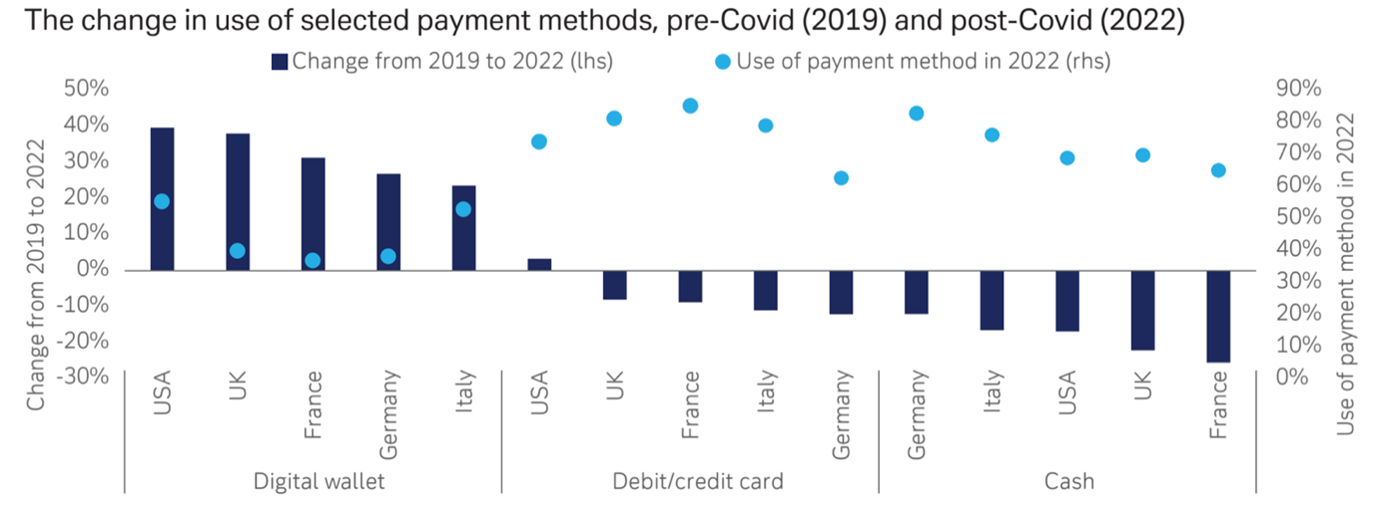

Another challenge is keeping up with global payment trends and providing localized payment options for customers. Mobile wallets, contactless payments, and buy-now-pay-later are just a few examples of modern payment methods growing in popularity at different rates in different parts of the world. Cash has been king in Japan for decades; however, this year, the use of coins has dropped as banks have started charging for large deposits.

Keeping up with changing global payment trends is a significant challenge when exploring international expansion. Source: Deutsche Bank/dbDIG Survey.

Buy-now-pay-later is also expected to account for nearly a quarter of all global e-commerce transactions by 2026, up from 9 per cent in 2021. To attract customers in a new jurisdiction, e-commerce businesses should offer the preferred payment options and adapt their marketing and customer service strategies to the area. Building trust with international customers is crucial, and this often involves providing multilingual customer support and transparent pricing that includes any import duties or taxes.

How local currency accounts can help

But e-commerce business owners should not allow these challenges to put them off international expansion. Taking a step-by-step approach can make the process feel less daunting, methodically researching target markets, ensuring compliance, and adapting to evolving payment trends before launching into new territories.

There are tools designed to alleviate some of the headaches associated with this kind of endeavor so decision-makers can focus more of their attention on strategic growth. One is an overseas currency account from leading foreign exchange (FX) and international payments company WorldFirst. Its localized currency accounts provide a natural hedging solution for managing finances in multiple currencies, and its staff specialize in helping businesses navigate the complexities of global trade.

Foreign currency bank accounts are valuable tools for businesses involved in international trade, primarily because they enable businesses to manage currency exchange rate risk more effectively. For example, US businesses operating globally can accept payments in foreign currencies like Euros, Pounds Sterling, or Australian Dollars. By maintaining these earnings in their respective foreign currency accounts, businesses reduce their exposure to potential losses resulting from unfavorable currency exchange rate fluctuations and avoid the immediate need for currency conversion into US dollars.

WorldFirst accounts provide local sort codes, account numbers, and IBANs, effectively creating the impression and ease of having local bank accounts in various countries. This simplifies the process of receiving payments in different currencies while eliminating the need to set up and manage several foreign bank accounts, which can be both time-consuming and costly. E-commerce businesses can seamlessly charge payments in the local currency of their customers, ensuring a hassle-free customer experience.

Local banking adds to the business’s profitability by avoiding expensive conversion charges. By holding foreign payments in the original currency, there is no risk of incurring additional costs due to unfavourable exchange rate fluctuations. Double conversion fees, where the bank charges for converting to the company’s domestic currency and then back to the foreign currency for expenditures in the foreign market, are also effectively eliminated.

As mentioned, businesses engaging in cross-border e-commerce often grapple with fluctuating currency prices that can impact pricing and profit margins. With a WorldFirst account, companies can lock in exchange rates through robust hedging solutions like forward contracts, providing e-commerce businesses with a means to protect themselves against currency volatility. This feature is particularly valuable in times of economic uncertainty, as retailers can maintain stable pricing and preserve their margins.

In addition to simplifying international finances and mitigating currency risks, WorldFirst’s local currency accounts empower e-commerce businesses to operate more efficiently in global markets. With connectivity to over 100 global marketplaces, users can make one-off or scheduled payments to individuals or send funds to up to 200 suppliers with just a single transaction. This efficiency is especially important for businesses with high transaction volumes or those managing complex supply chains.

WorldFirst is licensed with ASIC and holds customer funds in segregated accounts for their peace of mind. Its team of experts is accredited and has a deep understanding of cross-border payments to support its clients. They can help businesses navigate the complex landscape of international trade regulations, ensuring that account holders remain compliant with the laws of each target market. Moreover, WorldFirst’s expertise in global markets and payments can ensure e-commerce businesses stay ahead of evolving payment trends. The team can provide insights into the preferred payment methods in different regions and help retailers adapt their payment strategies accordingly.

Businesses can open up to ten WorldFirst local currency accounts for free and pay suppliers, partners, and staff in 40 currencies with no hidden costs. Discover how to expand your reach with WorldFirst by today.

What to look out for to avoid expensive overseas supplier payments when expanding your e-commerce business internationally:

- Exchange rates: Keep an eye on exchange rates to ensure you make payments at the most favorable times. Currency fluctuations can significantly impact your costs.

- Hidden fees: Be aware of any hidden fees associated with international payments, such as intermediary bank charges or receiving bank fees. Transparent pricing is essential.

- Conversion costs: Avoid double conversion fees by holding foreign payments in their original currency whenever possible. This helps eliminate additional costs due to currency conversion.

- Forward contracts: Consider using forward contracts to lock in exchange rates and protect your business against currency volatility. This can help maintain stable pricing and preserve your profit margins.

- Compliance: Ensure that your international payments comply with the laws and regulations of each target market. Non-compliance can lead to fines and legal consequences.

- Payment trends: Stay up-to-date with payment trends in the regions you’re expanding into. Different markets may prefer specific payment methods, so adapt your strategies accordingly.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications