(Source – Wise)

100,000 new personal and business customers join Wise weekly

- Wise is enabling customers to send funds to 11 more mobile wallets in Asia, including Touch n Go in Malaysia, GrabPay in the Philippines and ShopeePay in Indonesia.

- The world’s first international account for people, the account enables customers to send, spend, receive and hold money in 50+ currencies.

- More than 60 banks and large businesses including GooglePay, Deel and Monzo offer their own customers faster, cheaper and more efficient international payments, powered by Wise, through Wise Platform partnerships.

Asia-Pacific is currently the fastest-growing market for cross-border payments globally, and when it comes to cross-border payments, apart from assuring security and simplicity, providing the perfect customer experience is key.

As there are an increasing number of mobile apps promising cheaper, faster and better cross-border payments, many customers still find the experience not as smooth as they would expect it to be. For customers, it is all about having simplicity and security when using mobile apps be it for cross-border payments, fund transfers or even paying bills. Apps that provide this continue to be successful and are preferred by customers.

For example, Wise, a global technology company, allows customers to hold over 50 currencies, move money between countries and spend money abroad. Be it personal or business customers, Wise’s simplicity and ease of use see the app welcoming 100,000 new customers each week.

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched in 2011 under its original name TransferWise. It is one of the world’s fastest-growing, most profitable technology companies and is listed on the London Stock Exchange under the ticker, WISE. Today, about 16 million people and businesses use Wise globally, which processes £9 billion in cross-border transactions every month, saving customers around £1.5 billion a year.

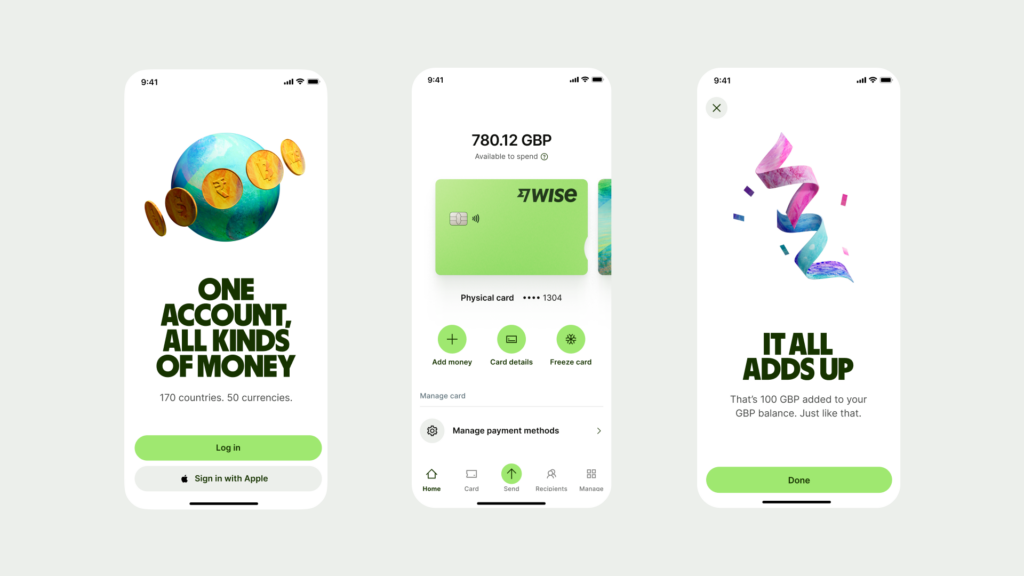

To ensure customers continue to have a pleasant experience, Wise has rolled out a new look and feel. This includes a complete visual makeover that features a fresh green palette and a bold new font and draws from global currencies, languages, alphabets and places around the world.

Designed to make the Wise customer experience consistent regardless of the place or language they sign up in, the look also underscores Wise’s mission to build money without borders and its ambition to create a fast, convenient, cost-effective and transparent global alternative to the traditional correspondent system.

Wise has rolled out a new look and feel. (Source – Wise)

Globally, Wise continues to invest in expanding its unique international account offer and underlying infrastructure. This includes:

- Wise Account: The world’s first international account for people, the account enables customers to send, spend, receive and hold money in 50+ currencies. Wise most recently introduced “Interest” in Assets in the UK, and “Balance Cashback” in Europe to the account 一 features to allow customers to earn a return on the money they hold in Wise, without compromising on their ability to instantly access their money when they need. Today, Wise also announced the launch of Assets in Singapore, and the feature will become available to customers in Europe next. In India and Israel, Wise has secured licenses to launch more services including the multi-currency account and card soon. Wise is also launching QR code payments for customers to pay like a local by scanning PayNow QRs at merchants and hawkers across Singapore. In addition, Wise is enabling customers to send funds to 11 more mobile wallets in Asia, including Touch n Go in Malaysia, GrabPay in the Philippines and ShopeePay in Indonesia.

- Wise Business: The one account for international businesses, Wise Business offers everything the personal account has along with business-specific tools like multi-user access, approval workflows, integrations into accounting software like Xero and expense cards for employees. Wise Business is used by over 300,000 businesses each quarter. In the US, Wise has begun rolling out cards to LLCs and sole proprietors.

- Wise Platform: More than 60 banks and large businesses including GooglePay, Deel and Monzo offer their own customers faster, cheaper and more efficient international payments, powered by Wise, through Wise Platform partnerships. Wise Platform also went live with Bank Mandiri, Indonesia’s largest bank by assets and global employment platform Multiplier. Wise Platform also grew existing partnerships by building a new withdrawal service for Tiger Brokers’ investors to withdraw from their trading accounts quickly at the mid-market exchange rate.

For Kristo Käärmann, co-founder and CEO of Wise, the new look is inspired by the millions of people and businesses worldwide that use Wise today. He added that it draws from where they come from, but also represents the excitement of the world open for them to conquer.

“Over the past year, we’ve introduced new features to make Wise more useful to our customers and made payments faster. We now deliver over half our payments to their recipient in less than 20 seconds. We also helped our customers save on fees 一 £1.5 billion compared to banks in 2022 alone.

But there’s a long way to go. People and businesses are still being duped by hidden fees and losing over £180 billion each year to their banks. This is money they could have otherwise used to pay bills, expand their businesses or even save for a rainy day. We don’t accept it and we’re committed to solving this for everyone, everywhere,” commented Käärmann.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications