CEO of OpenAI, Sam Altman, is planning to raise billions for a chip venture with the intention of building semiconductor factories. (Photo by Kent Nishimura/GETTY IMAGES NORTH AMERICA/Getty Images via AFP).

OpenAI wants to manufacture its own AI chips. Is Sam Altman being too ambitious?

- Sam Altman, CEO of OpenAI, is planning to raise billions of dollars with the intention of building semiconductor factories.

- Companies like G42 from Abu Dhabi and SoftBank Group have talked with Altman.

- The project includes collaborating with leading chipmakers, and the fabs network would be global.

In the lead-up to his surprising and temporary exit from OpenAI in 2023, Sam Altman embarked on an audacious mission to woo billions of dollars out of global powerhouses for his enigmatic chip endeavor, cryptically named Tigris. Reports suggest Altman’s trips to the Middle East last year were not mere travels to top up his sun tan, but strategic moves to secure financial support for Project Tigris, a clandestine venture disclosed by insiders in the same year. After all, OpenAI’s CEO envisions the birth of an AI-centric chip juggernaut poised to disrupt Nvidia’s AI dominance in the fiercely contested semiconductor realm.

However, Altman’s ambitions reach beyond AI chips. Another potential facet adding complexity to his role at OpenAI involves collaborating with Jony Ive, Apple’s former chief design officer. As revealed by a Financial Times report, Altman enlisted Ive’s design firm, LoveFrom, to spearhead the development of a novel consumer device for OpenAI. Allegedly backed by Softbank CEO Masayoshi Son, the influential Silicon Valley duo is drawing inspiration from the transformative impact of the iPhone’s touchscreen on internet usage.

Yet, with no finalized deal and OpenAI’s CEO’s brief departure, the company’s role in future developments remained uncertain. Until talks on building chip fabrication plants began to surface.

OpenAI CEO Sam Altman during a session of the World Economic Forum (WEF) meeting in Davos on January 18, 2024. (Photo by Fabrice COFFRINI/AFP).

What is the reason behind Project Tigris?

In Altman’s defense, since OpenAI unveiled ChatGPT over a year ago, the AI landscape has witnessed unprecedented interest from corporations and consumers. He isn’t wrong, though–the surge, in turn, has ignited an overwhelming demand for the computational prowess and processors essential for constructing and executing these burgeoning AI applications.

Altman has repeatedly emphasized that the existing chip supply falls significantly short of meeting OpenAI’s insatiable requirements. But Altman’s endeavors faced a temporary hiatus when he was briefly removed as OpenAI CEO in November. However, soon after his return, Project Tigris was revived. Altman has even explored the possibility with Microsoft, and sources say the software giant is showing keen interest in the venture.

What has Sam Altman planned for OpenAI now?

The latest development is that Altman has discreetly initiated conversations with potential investors, aiming to secure substantial funds not just for AI chips but for creating chip-fabrication plants, known as fabs. According to anonymous sources quoted in Bloomberg last month, these discussions were with the likes of G42 from Abu Dhabi, and the influential SoftBank Group.

“The startup has discussed raising between US$8 billion and US$10 billion from G42”, said one of Bloomberg‘s sources. “It’s unclear whether the chip venture and wider company funding efforts are related,” the report reads. This fab project apparently entails collaboration with top chip manufacturers, with the intention of establishing a global network of fabs.

While Bloomberg has previously hinted at fundraising efforts for the chip venture, the accurate scale and manufacturing focus have yet to be unveiled. Still in their early stages, these talks have not yet finalized the list of participating partners and backers, adding a layer of intrigue layer to this evolving narrative.

Is OpenAI’s venture into building its chip fabs a viable endeavor?

Ultimately, Altman advocates for urgent industry action to ensure an ample supply by the end of the decade, per sources familiar with his perspective. However, his approach, emphasizing the construction and maintenance of fabs, diverges from the cost-effective strategy favored by many AI industry peers, including Amazon, Google, and Microsoft—OpenAI’s primary investor.

These tech giants typically design custom silicon and outsource manufacturing to external suppliers. The construction of a cutting-edge fab involves a significant financial investment, often reaching tens of billions of dollars, and establishing a network of such facilities spans several years. A single chip factory’s cost can range from US$10 billion to US$20 billion, influenced by factors such as location and planned capacity.

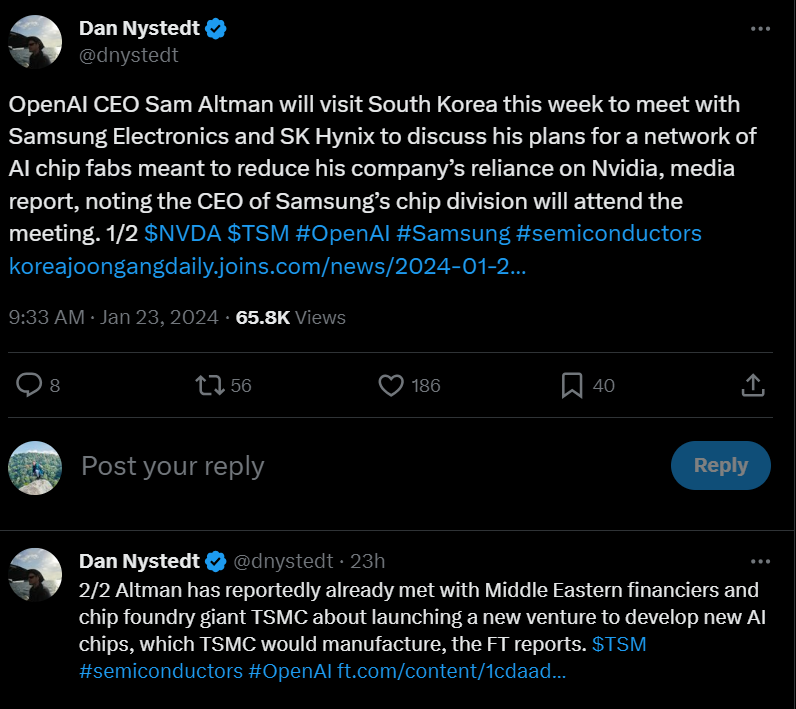

Is Altman looking for Korean expertise – and money? Source: X.com.

For instance, Intel’s Arizona fabs are estimated to cost US$15 billion each, and TSMC’s nearby factory is projected to reach around US$40 billion. Moreover, these facilities may require four to five years to complete, with potential delays due to current workforce shortages. Some argue that OpenAI seems more inclined to support leading-edge chip manufacturers like TSMC, Samsung Electronics, and potentially Intel rather than enter the foundry industry.

In an article for The Register, it’s hinted that the strategy could involve channeling raised funds into these fabrication giants, such as TSMC, where Nvidia, AMD, and Intel’s GPUs and AI accelerators are manufactured. TSMC stands out as a prime candidate, given its role in producing components for significant players in the AI industry.

“If he gets it done—by raising money from the Middle East or SoftBank or whoever—that will represent a tech project that may be more ambitious (or foolhardy) than OpenAI itself,” Cory Weinberg said in his Briefing for The Information.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications