The future of seamless cross-border payments: Navigating complexity in a changing financial landscape

Cross-border payments are critical in achieving Australia’s economic and development goals, according to the Treasury. In 2022, the Australian Bureau of Statistics reported that international trade activity was almost equivalent to half the value of total GDP. Yet international payments are known to be fraught with challenges and complexities for businesses. Ellis Connolly, the Head of the Payments Policy Department at the Reserve Bank of Australia, said that “payments made across borders via the banking system are too expensive, slow and opaque”. They are inherently more complex than domestic transactions, requiring adherence to international regulations and dealing with the intricacies of various currencies and legal systems.

Source: Shutterstock

The main challenges of international payments

Payment processing delays

Processing international payments is often exceptionally slower than domestic, sometimes taking up to five days rather than virtually instantaneous. This is largely due to the number of intermediaries involved, like correspondent banks, required to verify and clear the transaction before the funds can be successfully transferred. However, there are more factors at play, like Anti-Money Laundering (AML) and other fraud screening checks and errors in the payment information. This long processing chain and its traditionally manual nature increase the risk of delays. The speed that a cross-border payments platform can guarantee its customers can, therefore, greatly influence their buying decisions.

High fees

The multiple intermediaries often required to complete an international payment can add significant costs to the process, as they all charge individual fees for services. Regulatory costs and currency conversion charges can further erode the value of the transferred funds. Particularly in times of soaring inflation, getting a low price for cross-border payment services is a priority.

Legal issues

Cross-border payments are subject to many legal and regulatory requirements, which often vary from one country to another. This complexity can result in disputes and challenges, making issue resolution tortuous. Additionally, complying with international export controls, tax and data protection laws, reporting requirements, and other legal restrictions can pose significant hurdles by adding time and cost.

Security

The international nature of cross-border payments exposes them to multiple instances of security risk, including fraud, cyberattack, and identity theft. The involvement of multiple intermediaries and the transmission of sensitive financial information across borders make these transactions susceptible to breaches and unauthorised access, especially since different countries have different security standards. Breaches can be extremely costly, from recovering stolen funds to the ensuing reputational damage. Financial institutions and payment providers must implement robust security measures to protect against these threats, and customers will look out for trusted certification.

Lack of transparency

Beyond the obvious fees and charges incurred during cross-border payments, there are hidden costs that can impact both senders and recipients. These may include unfavourable exchange rates, which financial institutions sometimes leverage to generate additional revenue, and undisclosed fees from payment providers. This can inevitably lead to confusion and frustration for the customer, harming brand trust.

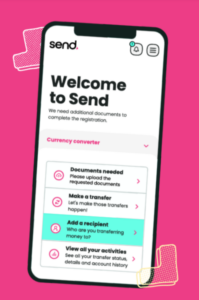

Source: Send Payments

A foreign exchange platform to address the challenges

Modular cross-border payments

While the idea of a smooth international payment process may seem almost impossible given the challenges, there are ways to mitigate their impact. One of these is implementing a modular payment solution to complete cross-border payments, which can be customised to the business’s specific needs.

For example, Australian company Send Payments offers a suite of different payment products through its API Platform, making it simple for developers to integrate only necessary features. Its modularity allows the business to streamline and automate various steps in the cross-border payment process, reducing the likelihood of errors that cause delays. By having a choice over the specific features and services that Send provides, businesses can strategically reduce their reliance on other costly software products. Additionally, the ability to integrate with existing infrastructure can help minimise costs associated with overhauling the payment processes in place.

Built-in compliance

Certain modular foreign exchange platforms offer ‘built-in’ compliance, helping to address the legal challenges of cross-border payments. Send handles adherence to KYC, AML and CTF regulations, as well as International Funds Transfer Instructions (IFTIs) and other types of regulatory reporting. By providing a comprehensive compliance framework, it minimises the risks related to financial misconduct and enhances the security and legitimacy of international transactions.

Bank-level security

The best modern solutions for cross-border payments will not compromise on security and match the standards of traditional banks. For Send, access to its systems is tightly controlled, and every action is meticulously audited, offering an additional layer of security and accountability. Furthermore, Send operates from ISO 27001 and PCI DSS-compliant AWS data centres, providing a trusted and secure environment for its operations. Data, whether at rest or in transit, is encrypted, ensuring that information remains confidential and shielded from unauthorised access. Every facet of its infrastructure is designed with the principle of least privilege, minimising vulnerabilities and enhancing the overall security posture.

Price transparency

Having access to a foreign exchange platform that discloses all associated costs is of paramount importance to businesses. Send’s solution actively addresses the challenge of hidden costs in cross-border payments by providing unparalleled transparency. By offering real-time exchange rates, forward contracts and a commitment to straightforward pricing, Send ensures customers have complete visibility into the actual costs of their transactions, reducing the risk of unexpected or undisclosed fees and the frustration that comes with them.

Businesses that provide cross-border payment services to their customers through Send have spoken about its positive impact on operational efficiency and customer experience. Rod Attrill, the CEO of Woolworths Team Bank, said: “Through our partnership with Send, we’ve enhanced our employer value proposition by providing transparent, innovative solutions to our loyal Woolworths team members and their families.”

BankVic – a prominent financial institution serving police, health and emergency services – has also recognised Send’s extensive expertise in international transactions. Anthony De Fazio, BankVic’s CEO, said its partnership with Send exhibits its commitment to user experience and ensuring its customers’ global transactions “are executed seamlessly and securely.”

Research has found that roughly 28 per cent of banking and fintech customers ranked the efficiency of cross-border payments as one of their top two key demands in 2022, while 56 per cent put the cost of payment processing in one of these positions. G20 countries like Australia have committed to help mitigate the challenges of international payments, working towards a 2027 roadmap that will make them cheaper, faster and more transparent. In addition, many new foreign exchange solutions are being developed as demand for a way around the challenges is only increasing. The cross-border e-commerce market is predicted to reach $52.7 trillion by 2027.

With such competition in the sector, businesses that offer customers the smoothest international payment services are poised to lead any industry. If you’re interested in learning more about how Send Payments can help your business overcome the challenges of cross-border transactions and maintain your competitive edge, speak to one of the expert team today.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications