Behind the screen of Singapore’s online scams epidemic. (Source – Shutterstock)

Is Singapore prepared for increasing online scams?

- Rising online scams prompt guidelines for proactive action by financial and telecom firms.

- Revolut survey shows 1 in 5 Singaporeans recently fell victim to online shopping fraud.

In a rapidly digitalizing world, the convenience of online shopping and banking has revolutionized how consumers interact with businesses. Yet, this shift has also exposed many to the lurking dangers of the digital realm. Scams, frauds, and deceitful tactics have emerged as significant concerns, with even the most cautious individuals falling prey to sophisticated cybercriminals.

While many believe they can navigate the treacherous online waters safely, a recent survey unveils a startling reality about the susceptibility of Singaporeans to online shopping fraud.

Singaporeans’ vulnerability to online scams

Revolut, the renowned financial superapp, in collaboration with the research firm Dynata, surveyed 1000 Singaporeans aged between 18 and 65+. The findings indicated that over 20% (1 in 5) had fallen victim to online shopping fraud in the past six months. The younger demographic, those between 18 and 34, experienced the highest fraud rate at 52%. In contrast, the elderly group, ages 55 to 65+, faced the least instances of fraud at 14%.

The most prevalent type of online fraud involved customers purchasing items that never got delivered. Other frequent scams included deceptive websites that pilfered credit card information and deceitful sellers who absconded with consumers’ funds.

Regarding recognizing deceptive websites or offers, nearly half (48%) of the Singaporean participants expressed uncertainty or a lack of confidence in their ability to identify them. Interestingly, male respondents exhibited greater confidence than their female counterparts: 57% of men felt confident about spotting fakes, compared to 47% of women.

A significant 85% of the participants voiced concerns regarding the security of their funds during online transactions. Further studies highlighted Singaporeans as highly vulnerable to fraud, incurring an average annual loss of SG$1648.52 due to fraudulent charges.

Repercussions for negligence: The expected framework

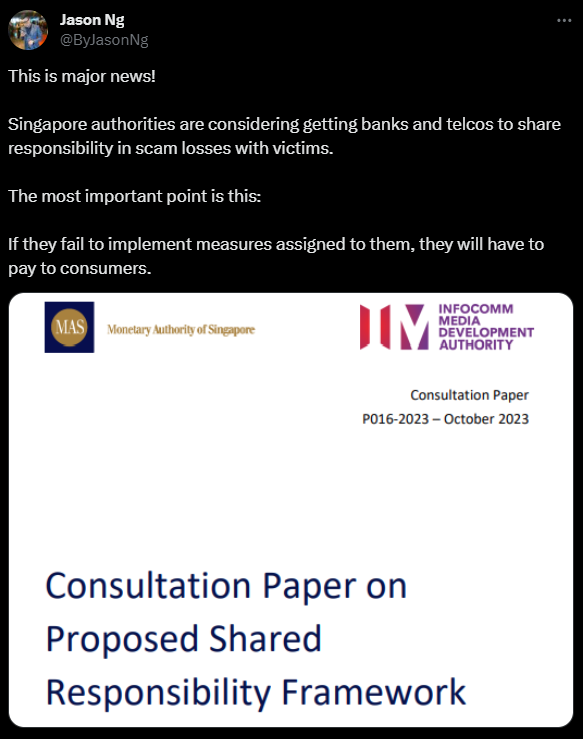

Highlighting these concerns, a CNA report suggested that Singaporean financial and telecommunication companies might soon be accountable for compensating scam victims if deemed negligent. The anticipated guidelines propose obligations for banks to issue transaction alerts and for telecom providers to install scam filters for SMS. Initially, the focus is curbing phishing scams, a significant unauthorized transaction source in the area.

This comes after the Monetary Authority of Singapore (MAS) and the Infocomm Media Development Authority (IMDA) introduced guidelines on dividing scam-related loss responsibilities between businesses and consumers. These recommendations emerged in response to an event in February 2022, where around 800 OCBC customers were duped out of SG$13.7 million.

Although MAS promised a draft framework within a quarter, complexities delayed its release, as noted in past legislative discussions.

The recent document emphasizes shared accountability, suggesting businesses, primarily financial and telecommunication entities, should proactively participate in scam prevention.

If these stakeholders fail in their anti-scam responsibilities, they may face direct repercussions from affected consumers. The proposed framework indicates that such entities should prioritize compensating consumers over self-interest if they neglect their duties.

The document notably includes telecommunication companies in its ambit, a feature absent in other jurisdictions’ scam reimbursement policies.

A “waterfall approach” determines loss accountability: if an entity defaults in its duty, it bears the loss; if both parties fulfill their obligations, the consumer does. The proposed guidelines emphasize caution, urging consumers to avoid suspicious unsolicited links.

Regarding the scams covered, the framework initially targets phishing scams with a clear Singaporean nexus. Examples include cons imitating local or internationally operating entities like SingPost or DHL. However, scams involving deliberate payments (e.g., romance or investment ruses) or those where credentials are shared non-digitally won’t be included. The emerging threat of malware scams is also currently excluded.

MAS and IMDA underscored the importance of delineating responsibilities in tackling malware-related scams. Leading banks are considering enhanced anti-malware measures and a “money lock” feature for extra safety.

The guidelines assign distinct duties to banks and telecom companies. Financial institutions must enforce holds on digital tokens, provide instant notifications for high-risk activities, offer transaction alerts, and allow users to suspend online payments promptly. On the other hand, telecom companies should partner exclusively with authorized SMS aggregators, block unauthorized SMS sources, and employ phishing link filters.

Singapore authorities are considering getting banks and telcos to share responsibility in scam losses with victims. (Source – X)

Despite these stringent guidelines, authorities stress that the best defense remains an informed and vigilant public. Good cyber practices and refraining from sharing credentials are paramount.

A new age of fraud: Navigating social media exploits

Revolut is ramping up its countermeasures by hiring top-notch professionals in light of the escalating global fraud menace. The company’s disclosures indicate that over one-third of its employees now focus on combating Financial Crime. This sizable team, exceeding 2,500 FinCrime specialists spread across six regions, operates in various capacities, including product development, data analysis, customer service, operations, and anti-money laundering endeavors.

Since 2021, the size of Revolut’s FinCrime division has witnessed a two-fold increase. This augmented focus on fraud prevention is yielding dividends: over the past year, Revolut has successfully thwarted potential frauds amounting to roughly SG$335m directed at its clientele.

Recently, as businesses employ more advanced fraud detection tools, swindlers are transitioning from traditional ‘fraud’ to more intricate ‘scams’. Statistics from the Singapore Police Force indicate a substantial 64.5% surge in scam victims during the initial half of 2023 (22,339 victims) compared to the same timeframe in the preceding year (13,576 victims). Of these, 55% suffered losses amounting to SG$2000 or less.

Swindlers are transitioning from traditional ‘fraud’ to more intricate ‘scams’. (Source – Shutterstock)

Nevertheless, amidst this industry-wide uptick in scams, Revolut has showcased its resilience by reporting a 35% decline in Authorized Push Payment (APP) Fraud on its platform since June.

Aaron Elliot Gross, the lead for Financial Crime and Fraud at Revolut, highlights the evolving nature of fraud. He notes an increasing trend of sophisticated criminal networks exploiting social media channels to victimize Revolut’s customers. These malefactors deploy manipulative tactics, like romance and investment hoaxes, luring individuals into executing transactions.

To consistently outpace these fraudsters, Gross emphasizes Revolut’s unwavering commitment to bringing aboard seasoned professionals in the domain, from anti-financial crime experts to adept data analysts and front-line representatives who assist fraud-stricken customers. The company also continually fortifies its defenses with cutting-edge artificial intelligence technology, enhancing its capability to pinpoint and curb anomalous transactional behaviors, thereby safeguarding its users.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications