Can data center growth in Australia fuel opportunities for more jobs? (Source – Shutterstock)

How does data center growth in Australia fuel opportunities for more jobs?

- Melbourne’s data center growth is shaping its digital landscape and driving significant job creation.

- Data center specialists like STACK are being drawn to the city.

- APAC’s digital expansion, led by Melbourne, signals a boom in both infrastructure and tech job opportunities.

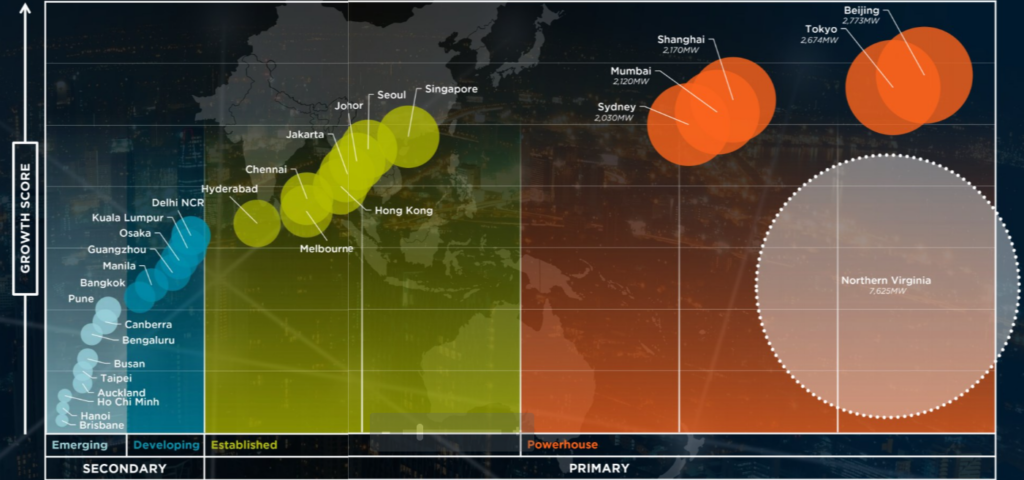

While Sydney has traditionally taken center stage when it comes to data center growth, rivaling powerhouse markets like Singapore and Tokyo, recent indicators point to a shift in focus towards Melbourne. With such rapid growth in the data center market, the immediate question that comes to mind is, “Are there enough jobs to support the growth?”

Melbourne’s digital transformation is not just based on market trends but also intersects with the city’s socio-economic backdrop, governmental strategies, and tech sector surges, which can potentially drive job creation.

Why Melbourne?

What’s making Melbourne a hotbed for such interests? A chunk of the credit goes to its advantageous socio-economic terrain, fertile ground for technological advancements, and favorable employment landscape. Melbourne’s administrative bodies have recognized the dual mandate of supporting tech growth while ensuring job opportunities for its residents.

By formulating policies that facilitate and promote the growth of the digital infrastructure, they are paving the way for more tech-oriented roles in the city. The city’s swift rise in the tech sector makes it an attractive destination for startups and tech giants, and by extension, a hub for career growth in the tech industry.

The digital shift led by cities like Melbourne isn’t just about infrastructure – it’s also about people. The burgeoning demand in sectors like artificial intelligence (AI) and machine learning (ML) is driving a need for specialists, engineers, and many other tech roles.

Australia’s rise as a data center powerhouse is simultaneously fueling the job market, answering the industry’s call for skilled professionals. From technical operations to sales and marketing, the ripple effect of this digital boom could potentially usher in a golden era of employment in the tech sector.

This upward trajectory in Melbourne is powered by the escalating demands of digital trendsetters, particularly from arenas like finance, alongside the explosive evolution of cutting-edge applications in fields such as AI and ML.

Australia’s data center market is on a growth spree. In 2022, its value was estimated at US$6.31 billion, with projections indicating a leap to an impressive US$9.49 billion by 2028, translating to a substantial CAGR of 7.05% between 2022 and 2028.

With businesses increasingly migrating to cloud solutions and undertaking digital transformations, there’s an amplified call for dependable, fortified data centers. Recognizing this, the Australian administration has rolled out a comprehensive digital transition plan, not only to facilitate businesses into cloud-based solutions but also to generate job opportunities in this realm. This strategic move combines policies and incentives to promote cloud integration, further enhancing Australia’s data center domain and its job market.

Data center titans in Australia: Shaping the future of jobs and infrastructure

Pioneers in the Australian data center arena, including CDC Data Centres, Digital Realty, and Equinix, are setting the pace with hefty investments. The stage also welcomes fresh faces such as GreenSquareDC and Stockland, all contributing significantly to the market dynamics and creating vast employment opportunities.

Cities like Chennai, Jakarta, Seoul, and Melbourne are collectively responsible for roughly a quarter of the total operational capacity in the wider region. Despite Singapore’s struggles with supply constraints, most of these markets, particularly Melbourne, are witnessing unparalleled growth. Melbourne’s meteoric rise speaks volumes about its evolving digital prominence.

Further underlining Melbourne’s digital prowess, STACK recently unveiled its inaugural Asia Pacific (APAC) data center in the city. Strategically positioned in one of the APAC region’s fastest-burgeoning markets, this facility is designed to meet the spiraling demands of cloud vendors and significant corporations. This Melbourne venture is just Step One, with STACK planning further expansions in cities like Tokyo and Seoul.

The 36MW facility on a campus set to total 72MW brings STACK’s globally-recognized scalability and delivery practices to a vital data center market in need of scalable capacity. (Image – STACK Data Center)

STACK’s role in Melbourne’s data center jobs landscape

STACK is bringing data center jobs to Melbourne.

Spanning 3.6 hectares and energized by a 105MW onsite substation, the 72MW campus houses two meticulously designed 36MW structures. These are equipped with individual access and varied fiber routes to ensure a diverse clientele, offering distinct security measures and services. The inaugural 36MW phase’s success and the impending second phase underscore STACK’s skill at meeting the swift rise in client requirements.

Pithambar (Preet) Gona, STACK APAC’s CEO, sees this initial APAC venture as a harmonious blend of STACK’s regional acumen and overarching global vision. Moreover, it’s a testament to Melbourne’s escalating stature in the digital domain.

Pioneering a global shift, STACK is offering versatile solutions to cloud service providers across severalcontinents. Its recent global ventures include:

- A prime data center hub in Osaka, Japan, encompassing 72MW of capacity spread over three towers.

- A 36MW Tokyo facility, with half under construction and the other half slated for expansion.

- A promising 48MW data center avenue in Seoul, catering to an expanding market.

- A proposed quintet of data centers in Central Phoenix, offering a colossal 250MW capacity, backed by a dedicated substation.

- A sprawling 55-acre campus in Portland with a potential of 200MW, of which 96MW is currently up for grabs.

- A strategically placed 84MW hyperscale data center nexus in Frankfurt.

STACK’s expansive portfolio and ever-growing international reach solidify its position as a premier private data center operator on the global stage.

Melbourne’s ascension and creation of jobs spotlight

The Asia Pacific is on a relentless march of expansion in dominant and ancillary data center markets, commanding 9.7GW in operation, another 3.3GW in the construction phase, and an ambitious 8.5GW earmarked for future endeavors. The Cushman & Wakefield APAC Data Centre H1 2023 report predicts that by 2024, eight prominent APAC markets will breach the 500MW operational capacity: cities include Shanghai, Sydney, and Tokyo, among others. Not far behind, regions like Johor and Hyderabad are gearing up to achieve similar operational milestones soon.

Asia Pacific data center markets maturity index – Will this help in creating more jobs in the field? (Source – Shutterstock)

The evolution of the data center landscape in the Asia Pacific, with Australia and particularly Melbourne at its heart, demonstrates the region’s strategic importance in the digital age. With investments pouring in and infrastructure continuously evolving, the future promises even greater digital integration, making the region a nexus of innovation and technological advancement.

The new STACK data center.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications