The smartphone brand by Google, Pixel, has been around since 2016, but it wasn’t until 2022 that the lineup “gained share in every market” the tech giant operated in.Source: Justin Sullivan/Getty Images/AFP (Photo by JUSTIN SULLIVAN / GETTY IMAGES NORTH AMERICA / Getty Images via AFP)

In Japan, Google is now the second biggest smartphone brand

- For the first time, Google became the second-largest smartphone brand in Japan.

- Google’s smartphone shipments in Japan were also the highest in the world.

- Shipments in Japan exceeded the US for the first time.

The smartphone brand by Google, Pixel, has been around since 2016, but it wasn’t until 2022 that the lineup “gained share in every market” the tech giant operated in. Even Alphabet CEO Sundar Pichai admitted that “2022’s Pixel 6a, 7, and 7 Pro are the best-selling generation of phones” the company has ever launched.

In fact, Counterpoint Research indicated in its latest report that solid sales of the mid-range Pixel 6a and flagship Pixel 7 and Pixel 7 Pro, which were launched in the second half of 2022, have pushed Google’s global shipments in the first three months of this year (1Q23) to 67% higher than the same period last year.

What is more interesting is that Pixels is turning out to be a big hit in one market in Asia, mainly Japan. Counterpoint Research reports that Pixel phones are seeing massive growth in the Japanese market, recording impressive sales in January-March.

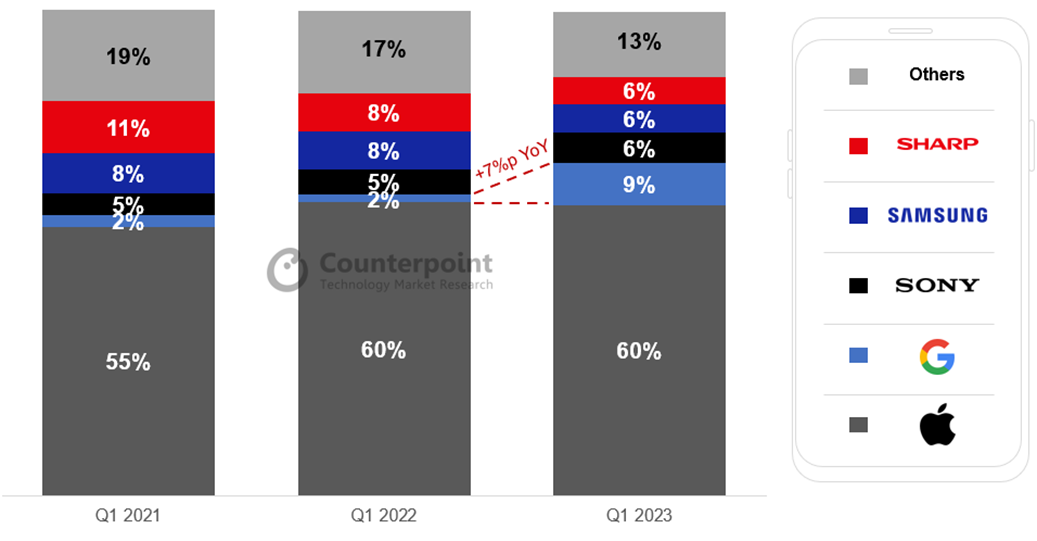

So much so that the Google smartphone brand is now the number two smartphone maker in the country after Apple, accounting for 9% of the market in the quarter. This represents 67% growth compared to a year ago, beating the overall smartphone market’s downturn.

“In Japan, Google’s smartphone shipments increased nearly fivefold in 1Q23 to reach an all-time-high share of 34% in the brand’s overall global shipments and secure the top position,” the report reads.

Japan Smartphone Shipments Market Share by OEM, Q1 2023. Source: Counterpoint Market Monitor, 2023

On the other hand, while maintaining similar shipment levels of Google smartphones compared to the previous year, the US market slipped to second place due to the growth in Japan’s contribution. The US market’s share dropped by 20%, from 51% to 31%, Counterpoint noted.

The main driver of Google smartphone growth in Japan

For context, the recent launch of the Pixel 7a has seen a 74% increase in cumulative sales during its first three weeks compared to its predecessor. According to Counterpoint’s finding, this indicates a growing positive response to Pixel smartphones in the Japanese market.

Top down view of unboxing a brand new Google Pixel 7 Pro. Source: Shutterstock

“The main drivers of the Pixel 7a’s success are its upgraded Tensor G2 processor, camera performance, and RAM. The Pixel 7a’s specifications are comparable to the flagship Pixel 7 series, but the device comes at a roughly 24% lower price,” the report added.

To top it off, the Japanese market’s preference for smaller screen sizes has significantly influenced the strong sales of the Pixel 7a. Moreover, unlike its predecessor, the Pixel 7a is available for purchase through all three major carriers in Japan – SoftBank, AU, and DOCOMO. In contrast, the Pixel 6a was only available through SoftBank and AU.

In Japan’s smartphone market, carrier partnerships substantially impact sales. That is why the Pixel 6a achieved impressive results, remaining the top-selling Android smartphone for seven consecutive months from September 2022 to March 2023. “With the Pixel 7a’s improved specifications and the addition of major carrier DOCOMO, the model is expected to deliver even better performance than its predecessor,” Counterpoint reckons.

Local brands’ withdrawal is a plus for Google in Japan

The growth within the first three months of this year has pushed Google to achieve its highest-ever market share in Japan at 9%, surpassing local brands such as Sharp and Sony to secure the second position after Apple, which has historically dominated the market with over 50% share.

On the other hand, local brands have exerted significant influence in the Android camp. Therefore, Google’s performance in the Japanese market holds substantial implications. Moreover, the withdrawal of local brands such as Kyocera, FCNT, and Balmuda from the smartphone market indicates that Tier-1 Japanese OEMs will be limited to only Sony.

“This is expected to strengthen the market dominance of US brands like Apple and Google in Japan. However, considering the maturity of the Japanese smartphone market, Google’s shipment growth is expected to be modest. As a result, Google’s strategy for expanding its global market share through the Japanese market may have some limitations,” Counterpoint concluded.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications