Rockwell Automation: Beating the odds and growing strong in Asia PacificSource: Rockwell Automation’s Twitter

Rockwell Automation: Beating the odds and growing strong in Asia Pacific

- Rockwell Automation Asia Pacific president Scott Wooldridge shares how Asia Pacific remains one of the company’s most important markets, growing strong in terms of revenue and workforce.

- Wooldridge reckons India, Vietnam and Indonesia being the markets with most growth opportunities for Rockwell within APAC.

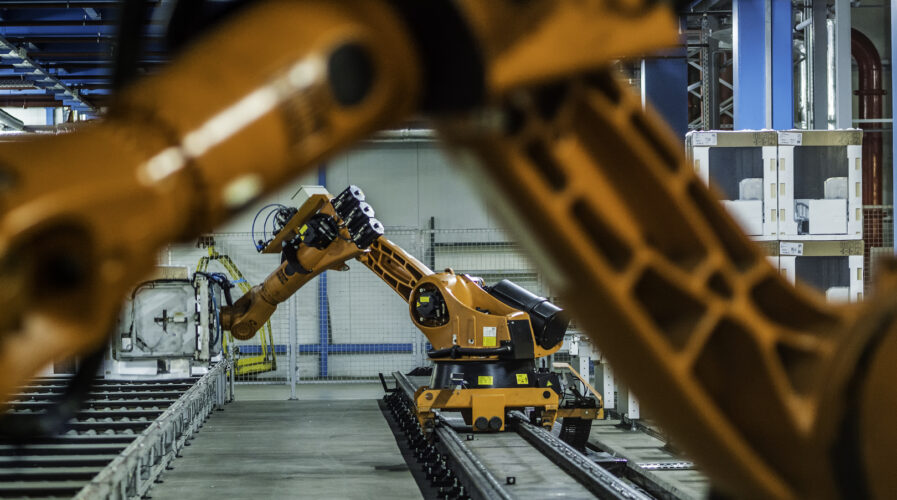

As one of the leading vendors for industrial automation services, Rockwell Automation is known for supporting companies across a broad range of manufacturing activities and enterprise digitalization. The company operates worldwide with North America being its largest market. Over the last few years however, Asia Pacific has been gradually growing to become a significant market for Rockwell.

It is especially apparent in its financial results: sales, orders, and earnings grew in double digits during the recently concluded fourth quarter and fiscal 2022. In a November 2 statement, Rockwell noted that it had delivered strong operational performance even in Asia Pacific, amidst continued supply chain volatility, significant inflation, and currency headwinds.

“Our strong orders and sales performance in fiscal 2022 reflect the compelling value we provide to our customers across many industries and regions,” CEO and chairman Blake Moret said. He also noted that Rockwell’s record backlog, underlying customer demand, and a more resilient operating model positions them well for another year of profitable double-digit growth.

“Now more than ever, Rockwell is committed to investing in attracting and retaining key talent. It’s the people who bring our strategy to life by supporting the immediate needs of our customers while focusing on continued innovation and investments for the future,” Moret concluded.

Tech Wire Asia took the opportunity to speak with Scott Wooldridge, president for Rockwell Automation Asia Pacific, at the recent Automation Fair held in Chicago. The conversation centered around Rockwell’s presence in the Asia Pacific and how a company dedicated to industrial automation and digital transformation steered itself through rough economic conditions.

The interview has been edited and condensed for clarity.

How has Rockwell Automation been performing in Asia Pacific over the last two years?

In general, the business has been strong, you would have seen our results this year where we had similar revenue growth to last year’s, particularly in Asia Pacific. I think we had the benefit of being in key industries we work in, particularly in Asia. Those industries include life sciences, semiconductor, and tyres among others and that certainly helped sustain our business. Today, we also do a lot of professional services work besides providing products.

With services, it was certainly challenging, because we’re used to having a mobile workforce. Border restrictions did not make it easier, so that prompted us to look at our resourcing in Asia. We grew our resources for the region by more than 10% last year. In general, we have been investing significantly in Asia. Overall, despite the challenges, the period had a lot of growth as well.

You mentioned that you grew your resources pool by 10% last year. Do you see that being a problem right now considering the waves of layoffs?

Yeah, I don’t see that happening, not in the short term as well for Rockwell. It is certainly not a part of our strategy. We have acquired companies and made strategic investments and having a diversified industry portfolio actually gives us some protection. In fact, we have customers that have been with Rockwell for 70 to 80 years and even in a recession, they look at different ways to optimize their supply chain or manufacturing.

Scott Wooldridge, President, Asia Pacific

We often find different parts of our business grow during a recession, faster than some other segments.

What are the revenue contributions like from APAC, and what is it like in terms of workforce?

It is approximately 14% by revenue and by headcount it’s 7,000 out of 26,000 globally. The headcount makes up to 20 to 23% of the global headcount and that is reflective of our global engineering centers and software development campuses in Asia that support our global efforts.

In the whole of APAC, which country or market would you reckon IS the strongest for Rockwell?

Our largest market in Asia is China.

Considering that China is repetitively in a very tight Covid zero policy, how has that been for Rockwell? Has that been disruptive to your business?

It hasn’t been disruptive because we have a critical mass in China, so it’s relatively self-sufficient. In fact, for the first time in three years, we had four of our China team join us at this event. Generally, our two largest pools of people in Asia are India and China, so there’s a fair amount of self-sufficiency on the ground. In terms of what we do in both the countries, there is some manufacturing in China for global export as well as some software development, but less people for the global operations as opposed to India.

As a company, we have a stated objective to grow faster in North America and Asia Pacific and that clearly means we want to geographically diversify. China is still a growth engine for us and it is growing as fast as anywhere else and we are still investing in the country. But if I look more broadly, we see good opportunities in particular in India, Vietnam and Indonesia, as large markets that are growing quickly and are aligned to our verticals.

What excites you about India since there are quite a lot of policy tailwinds as well?

I have certainly seen that change over the last five years. Everything from taxation policy to the ability to get permits for new facilities, there’s been a definite improvement. Especially in the ability of local governments to drive decisions quickly and help improve the industrial footprint. We are also seeing investments everywhere from semiconductor to EV, on top of our very large footprint in Life Sciences.

I think when it comes to doing business there, traditional concerns around taxation, planning permits, and infrastructures have improved substantially. That said, we see India as a growth driver for our business.

In your opinion, which of your business segments has the biggest growth opportunity in APAC?

I think as a sustainable growth industry, electric vehicles are very important and we work across the supply chain — we work with mining factories, with battery production, in almost every assembly, and we also work in battery recycling. So that gives us opportunities with multiple different types of customers. To top it off, one of Rockwell’s strongest vertical markets is tires. Even semiconductors have grown dramatically, which we think is a great opportunity, but not necessarily sustainable at that level. Life sciences is strong across the region and at Rockwell our second largest division is food and beverage, it’s one of our recession-proof areas.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications