Nutanix is hoping to benefit from the acquisition. (Image by Shutterstock)

Nutanix confident on boosting customers as Broadcom closes VMware acquisition

- Broadcom VMware acquisition closes.

- One company that is hoping to benefit from this acquisition is Nutanix.

- Nutanix CEO believes customers will want to reduce dependence on VMware.

The VMware Broadcom deal has closed. China has approved the acquisition – with some restrictive conditions. But it’s enough to see the US$69 billion acquisition go through. Now the real journey begins for both tech giants.

While layoffs will be a concern, as with any takeover, merger, or acquisition, it is not the only problem VMware will have to deal with. It is most likely that the acquisition may not see layoffs as heavy as those experienced by companies previously acquired by Broadcom.

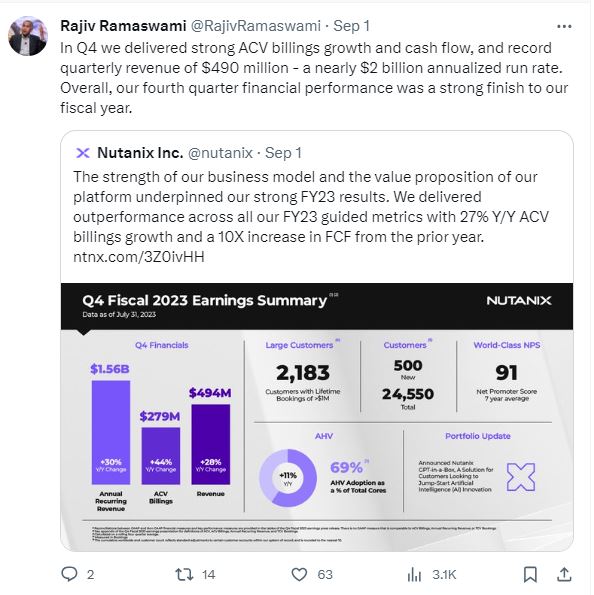

But competitors are taking the opportunity to make their voices heard as the deal closes. One company that is hoping to benefit from this acquisition is Nutanix. The tech giant is often seen as an essential competitor to VMware, especially since both companies provide high-performance, efficient infrastructure.

Rajiv Ramaswami, president and CEO of Nutanix, would know best. The former VMware executive joined Nutanix in December 2020, just before Dell Technologies had completed the spin-off of its 81% equity ownership of VMware.

“VMware has historically been an innovative tech leader, but this acquisition changes customers’ relationship with the company going forward. If you look at its history, Broadcom’s whole business model has been to maximize acquired assets in two to three years.

Nutanix CEO believes the acquisition may work in its favor.

“VMware customers will feel this. From their customers to their employees, we’re hearing concerns over these changes, and we’re the best option for customers looking to reduce their dependence on VMware,” said Ramaswami.

Echoing Ramaswami’s words was Dave Raffo, a senior analyst at the Futurum Group. Raffo said there had been a lot of anxiety about the Broadcom VMware acquisition around pricing, support, and other issues.

“Nutanix AHV is one hypervisor option that VMware customers have. AHV has been out there for years, with most Nutanix customers already using it, many of them alongside VMware ESXi. That means many VMware customers are already familiar with AHV, and it runs the same HCI workloads,” he said.

Nutanix also shared comments from several customers who had switched to Nutanix after using VMware. Generally, most Nutanix customers felt they were getting a better bargain by using Nutanix as compared to VMware.

The Broadcom VMware acquisition has closed. (Photo by Josep LAGO / AFP)

Broadcom focused on supporting VMware innovation

Hock Tan, President and CEO of Broadcom stated that that both companies will now focus on helping global enterprises address their complex IT infrastructure challenges by enabling private and hybrid cloud environments and helping them deploy an “apps anywhere” strategy.

“Broadcom is committed to innovation. That’s in our DNA and why we plan to invest significantly each year to advance VMware’s innovation and customer value. Half of the investment will be focused on R&D, and the other half will help accelerate the deployment of solutions through VMware and partner professional services. We are committed to creating value and driving revenue for our robust partner ecosystem, which has been made stronger with the addition of VMware’s partners,” said Hock Tan in a statement.

Specifically, Broadcom will invest in VMware Cloud Foundation, the software stack that serves as the foundation of private and hybrid clouds. Incremental to Broadcom’s investment in VMware Cloud Foundation, VMware already offers a rich catalog of services on top of VMware Cloud Foundation to modernize and optimize cloud environments. This includes application networking and security, modern application and software-enabled innovations from data center to the edge.

Broadcom’s focus moving forward is to enable enterprise customers to create and modernize their private and hybrid cloud environments.

Cybersecurity concerns linger post Broadcom VMware acquisition

Following China’s acquisition approval, GlobalData, a data and analytics company, stated that the ensuing delay had caused ripples in the cybersecurity industry and potentially affected VMware’s standing and share value. Despite VMware’s Q2 fiscal year 2024 revenue growth, the contrast in share value trends between VMware and Broadcom is evident.

With the cybersecurity market projected to reach over US$282 billion by 2027, the acquisition adds complexity to the competitive landscape, especially with the delay in the deal’s closure and lack of a straightforward story to date in the cybersecurity segment with the VMware acquisition.

“VMware is an established player with a solid foundation and strategy, and this cuts across its cybersecurity portfolio. Even though China has approved the deal with restrictive conditions, the acquisition post closure will continue to create uncertainty for its cybersecurity customers, particularly on larger cybersecurity deals, in an already aggressively competitive market,” commented Rajesh Muru, principal technology analyst at GlobalData.

Although VMware’s total revenue for Q2 of the fiscal year 2024 was US$3.41 billion, the delay in the transaction closing has impacted VMware’s share value. At the same time, this has had the opposite effect on Broadcom shares, which a week ago were at a positive US$957.52, potentially influenced by Broadcom’s direction on AI concerning its semiconductor chip business.

With the cybersecurity market growing, GlobalData forecasts that the key sub-product areas include network, endpoint, and cloud security, all aligned with Broadcom and VMware’s cybersecurity portfolio strengths.

“In a cybersecurity market fueled with end-to-end security monitoring for distributed customer cloud environments in zero trust settings, coupled with observability data monitoring, the competition is aggressive with the likes of Cisco, Palo Alto Networks, and Zscaler. If Broadcom is not careful, the potential impact on VMware’s brand equity could be high in the short term due to customer uncertainty, and this could cover portfolio consolidation for its cybersecurity business,” Muru explained.

With China’s approval in the eleventh hour being a relief to shareholders across both organizations, the US’ tough stance on China’s on-chip controls could have been a catalyst for the deal not going through. At the same time, GlobalData believes that this month’s presidential meetings between Xi Jinping and Joe Biden during the APEC summit could have played a role in lowering the barriers between the two state powers to do business.

“It must be a relief for both companies that this deal has gone through. But the by-product of this stand-off has been the possible decremental impact on VMware’s overall business and share value, including its cybersecurity business, as customers are swayed towards competitors with more robust and stable future cybersecurity product lines,” concluded Muru.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications