The legal and market dynamics shaping Nvidia’s path in AI leadership (Source – Shutterstock)

How Nvidia navigates through legal complexities and market cap dominance

- Nvidia hits US$2 trillion market cap, outshining legal issues with AI focus.

- Legal hurdles can’t slow Nvidia; market value and AI dominance climb.

- Nvidia’s AI strategy drives market cap past rivals, despite legal fights.

Legal challenges, and market dynamics presents a fascinating narrative that shapes the fortunes of leading corporations. Among these, Nvidia, a titan in the field of AI, has recently been at the center of a noteworthy legal dispute while simultaneously experiencing an unprecedented surge in its market valuation.

This complex scenario provides a rich case study for examining the broader implications for the tech industry, market competition, and the legal frameworks that govern intellectual property rights.

Nvidia found itself embroiled in controversy when three authors—Brian Keene, Abdi Nazemian, and Stewart O’Nan—levied accusations against the company for allegedly using their copyrighted works without permission. These works were purportedly incorporated into a substantial dataset of approximately 196,640 books to advance the capabilities of Nvidia’s NeMo AI platform, a sophisticated system aimed at mimicking human language.

The fallout from these allegations led to the dataset’s removal in October, underscoring the legal complexities surrounding copyright infringement in the digital age.

A meteoric rise in market valuation

Despite facing this legal hurdle, Nvidia has witnessed a surge in its market valuation, underscoring the intense investor interest in AI technologies. This rise is indicative of the broader trends in the semiconductor industry, where demand for AI chips, particularly those powering popular applications such as ChatGPT, has skyrocketed.

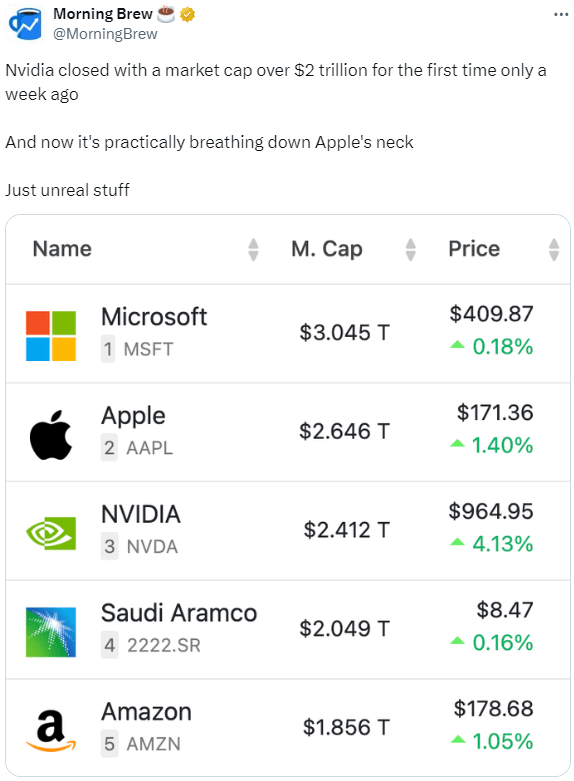

Within a span of nine months, Nvidia’s market value soared from US$1 trillion to over US$2 trillion, surpassing industry giants like Amazon.com, Google’s parent company Alphabet, and Saudi Aramco in the process. This meteoric rise has positioned Nvidia as a formidable contender in the race to become the world’s second-most valuable company, trailing closely behind Apple and Microsoft.

As reported by Reuters, Nvidia’s current market capitalization, standing at approximately US$2.38 trillion, exemplifies the fierce competition at the apex of the global corporate sector. This competitive landscape is not only defined by market valuations but also by the continuous drive for innovation and the development of high-quality products that resonate with consumers and enterprises alike. Apple’s journey to becoming the world’s most valuable company in 2011, bolstered by its array of successful products and services, highlights the critical role of brand loyalty and product innovation in achieving market dominance.

Nvidia’s mastery over legal hurdles and market cap peaks (Source – X)

On the other hand, Microsoft’s ascendance in 2024 to claim the title of the most valuable company globally emphasizes the significance of strategic investments in technology, particularly AI. With over 70% of computers worldwide running on Windows, according to Statcounter, Microsoft’s influence extends beyond its operating system. The company’s diversified portfolio, including the Office Suite, Azure cloud platform, Xbox consoles, and Surface devices, alongside a substantial investment in OpenAI, demonstrates its commitment to shaping the future of technology.

Nvidia’s stronghold over the high-end AI chip market, commanding 80% of the sector, combined with its significant stock performance, has propelled Wall Street to new heights this year. This success story is a testament to the investor enthusiasm for AI technologies, positioning Nvidia and Meta Platforms as leaders in a market increasingly focused on digital innovation.

Industry experts, such as Richard Meckler of Cherry Lane Investments, attribute Nvidia’s robust market performance to the solid fundamentals underpinning its business model and the speculative support from investors. This blend of strong business practices and market speculation has facilitated Nvidia’s steady climb in stock value throughout 2024, even as it faces legal challenges and stiff competition from tech giants like Apple and Microsoft.

Apple’s recent challenges with iPhone sales and the shift in market capitalization rankings underscore the dynamic nature of the tech industry, where companies continually vie for leadership positions. Meanwhile, Nvidia’s competitive forward price-to-earnings ratio and the insights from David Wagner of Aptus Capital Advisors suggest that Nvidia represents an attractively priced stock within the AI narrative, with the potential for significant growth in the coming years.

Facing the peaks: The Nvidia market cap challenges

However, as Nvidia’s stock approaches what some analysts believe to be its peak, the challenges of sustaining rapid growth in the face of increasing market capitalization become apparent. The speculative nature of stock valuations, coupled with the potential for innovation and market expansion, presents a nuanced picture of Nvidia’s future prospects. Should Nvidia continue to surpass analyst expectations, it could maintain or even enhance its market position, reflecting the intricate balance between innovation, legal challenges, and market dynamics.

Nvidia’s recent experiences offer valuable insights into the challenges and opportunities faced by leading tech companies today. As legal disputes unfold and market valuations fluctuate, the broader implications for the tech industry, intellectual property rights, and the ongoing pursuit of innovation remain subjects of keen interest. Nvidia’s journey through these complex landscapes underscores the dynamic interplay between legal considerations, market competition, and the relentless drive for technological advancement.

As the industry moves forward, the lessons learned from Nvidia’s story will undoubtedly influence future discussions on copyright law, market dynamics, and the role of AI in shaping the digital future.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications