China is planning a new state-backed investment fund to raise US$40 billion for its chip sector, the highest amount yet. Source: Shutterstock

China defies US sanctions with Huawei’s breakthrough and US$40bn state-backed chip fund

- China is planning a new state-backed investment fund to raise US$40 billion for its chip sector, the highest amount yet.

- Among the critical areas of investment would be equipment for chip manufacturing.

- How the US will respond remains to be seen.

In China, a secretive Big Fund has played the role of Beijing’s primary vehicle for distributing capital to the country’s chipmakers for the last nine years. Founded in 2014, the China Integrated Circuit Industry Investment Fund operated mainly behind the scenes and kept investment standards away from public view. But based on all publicly available information, two funds were raised, totaling 138.7 billion yuan (US$19 billion) in 2014 and 200 billion yuan (US$27 billion) in 2019.

There are talks that the Big Fund is now looking to raise more funds, likely to be the biggest of three funds launched to date. “China is set to launch a new state-backed investment fund that aims to raise about US$40 billion for its semiconductor sector,” Reuters reported earlier this week.

Citing its sources, Reuters noted that one main area of investment will be equipment for chip manufacturing, signaling China’s move towards self-reliance despite the intensifying US sanctions. The country’s finance ministry may contribute 60 billion yuan to the fund, which recently won approval to operate. However, the report added that the process may take time, and it’s unclear who the potential investors were or when it might launch.

Workers operate intelligent machines to produce LED product orders at the production workshop of Jiangxi Lanke Semiconductor Co., LTD in the emerging industry base. Source: Shutterstock

How has the Big Fund been helping the chip sector in China?

The Big Fund became dormant for a few months following the anti-graft investigations in 2022. Regulators launched probes into alleged graft involving the fund and affiliates as top Chinese leaders grew frustrated with a lack of breakthroughs in developing semiconductors to replace imports after years of ample government investments.

The probe was also triggered when the US and its allies tightened restrictions on China’s access to critical technologies. The Big Fund has so far backed China’s two biggest chip foundries, Semiconductor Manufacturing International Corporation and Hua Hong Semiconductor, Yangtze Memory Technologies, a flash memory maker, and several smaller companies and funds.

To top it off, just a few days ago, Chinese telecommunications giant Huawei launched its “most powerful” smartphone yet, which was shown to contain an advanced chip made by SMIC, indicating that the country is progressing in replacing American technology – and that it won’t be smothered by US sanctions.

The Big Fund’s latest round of financing took place in late December 2022, giving it a 5.7% stake in Heyan Technology, which specializes in producing high-precision equipment that manufacturers of chips use to cut silicon wafers. It was followed by an announcement that Heyan had finalized plans to invest 315 million yuan (US$45.7 million) to build a new factory for semiconductor manufacturing equipment in Shenyang.

The new investment is in line with the stated goals of the Big Fund since it entered its second phase in 2019. Speaking at a summit in 2021, former head of the national fund, Dīng Wénwǔ, stated that one goal of the fund’s second phase would be to invest in companies that produced semiconductor manufacturing equipment, to bolster domestic chip supply chains.

Besides Heyan, other semiconductor equipment makers that received funding from the national chip fund in 2022 included Weiteng Semiconductor, TETE Laser, Leiming Laser, and Cowin Laser, all of which manufacture machines that cut silicon wafers. Still, the corruption scandals in which the Big Fund was mired in last year appear to have influenced the investment activity for the year — from late March through August, the Big Fund made zero investments, according to local reports.

Overall, the fund made eight investments in 2022, down from 14 in 2021.

US’ chip prowess may be a ‘want’ and not a ‘need’ for China

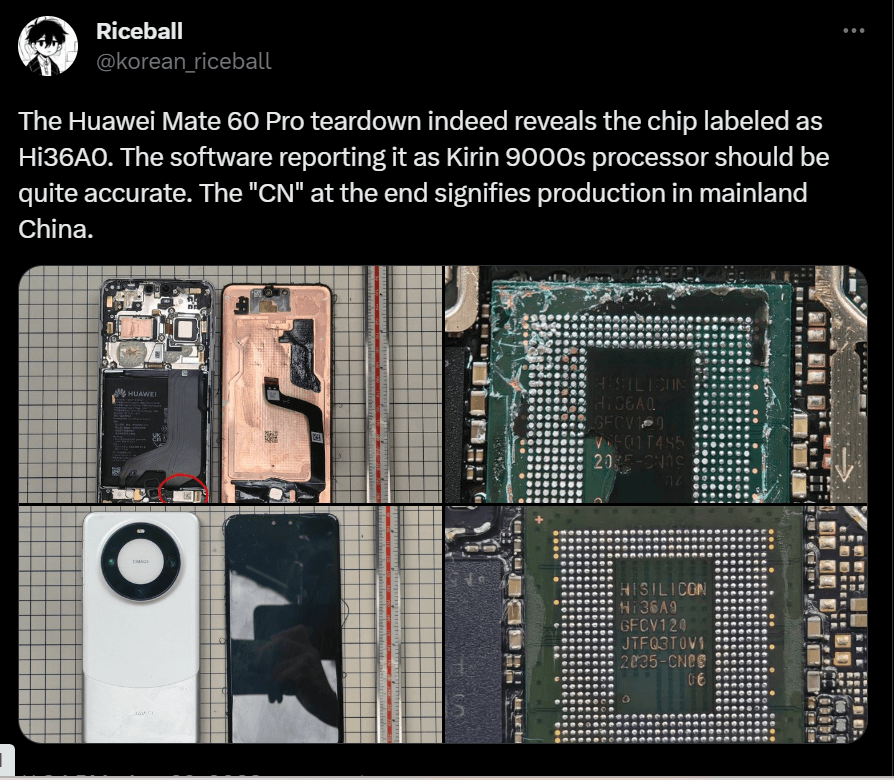

The new Huawei phone, the Mate 60 Pro, powered by a new Kirin 9000s chip, is the first to utilize SMIC’s (the biggest beneficiary of the state-backed Big Fund) most advanced 7nm technology. The China-made chip marks a clear win for the country in its attempts to defy Washington’s sanctions.

So much so that, although Huawei has been silent on the technology behind the chip in its latest phone, the Mate 60 Pro has triggered an outpouring of nationalist sentiment, with netizens hailing the device as proof that China can make technological breakthroughs in the face of tough US sanctions.

The Huawei Mate 60 Pro teardown proves the speculation about high-speed chips to be right. Source: Twitter

Nationalist tabloid the Global Times published an editorial last week saying the new handset proves that “extreme suppression by the US has failed.” State-backed broadcaster CCTV hailed the Mate 60 Pro as a phone powered by “Chinese chips” and said in a report over the weekend that more than 10,000 components in the Mate 60 Pro were manufactured domestically without identifying any suppliers.

While the Chinese aren’t yet able to make advanced chips in quantity or the state-of-the-art semiconductors the West is already deploying in consumer products, it would surprise no-one if they get better at it, fast — significantly, if the government is raising US$40 billion to support the domestic chip industry. As experts around the world have said, the US can always tighten its sanctions and strengthen its safeguards to slow the proliferation of China.

But as the saying goes, “What doesn’t kill you, makes you stronger.”

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications