As per federal filings, the Chinese telecom giant invested over US$13 million in lobbying over the last decade. (Photo by Josep LAGO / AFP)

China decouples: Huawei ends US lobbying

- Huawei is signaling the end of the company’s lengthy and expensive endeavor to stay in the North American market, as China is ramping up decoupling efforts.

- Lobbyists leaving coincide with a larger staff departure from Huawei’s US operations.

- As per federal filings, the Chinese telecom giant invested over US$13 million in lobbying over the last decade.

Over a decade ago, China-based Huawei Technologies kickstarted its costly, years-long effort to secure its presence in the North American market. In the initial stages of its endeavors, the Chinese telecommunication giant swiftly increased lobbying expenses in Washington because the US was actively looking into whether the company’s presence provided opportunities for Chinese espionage and imperiled America’s telecommunications infrastructure.

But since it started getting scrutinized in 2012, Huawei has denied all claims, especially on its alleged ties to the military in China. Washington, however, has been having a hard time buying that. After all, Huawei was the world’s largest supplier of telecom equipment and the second-largest maker of mobile phones. Its technology touches virtually every corner of the globe, and its massive R&D budget has made it a leader in 5G technology.

That is why Washington started raising concerns about Huawei’s potential to incorporate espionage features in its equipment, which was widely deployed in numerous cell towers and network infrastructure across the US. Despite the company’s assertions that its products were not a threat, by 2022, American regulators had prohibited Huawei from selling its products in the US. They took steps to limit its access to advanced technology.

Still, Huawei continued its foray into lobbying in the US as it still held ambitious plans for market expansion. The company had always planned to establish a stronger foothold in the American telecommunications landscape. Still, it also became apparent that navigating the complex regulatory environment and addressing concerns related to national security were paramount.

Unsurprisingly, Huawei’s lobbying efforts faced formidable challenges, particularly as the company became a focal point in the US-China trade tensions. On top of espionage, allegations of cybersecurity threats and growing skepticism from policymakers posed significant hurdles.

In due course, Huawei became ensnared in a complex network of restrictions, notably being added to the Entity List by the US Department of Commerce. Despite challenges, Huawei adopted a multi-faceted approach to counter the negative narrative. The company invested heavily in building relationships with lawmakers, government agencies, and industry influencers. After all, Huawei has aimed to dispel concerns about its ties to the Chinese government and present itself as a responsible and transparent player in the global technology landscape.

Huawei also launched extensive public relations campaigns to improve its image. These campaigns highlighted the company’s contributions to technological innovation, job creation, and efforts to bridge the digital divide.

Eventually, the company initiated a gradual reduction in its lobbying endeavors, culminating in a complete cessation, as reported by Bloomberg last week.

How much did Huawei spend lobbying in the US?

It was Huawei itself that officially notified the termination of its lobbying activities at the Capitol. The company has also discontinued its operations at the Plano, Texas offices, as confirmed by Trey Smith, the executive vice president at CBRE, a real estate services firm managing leases for the building, in an email to Bloomberg.

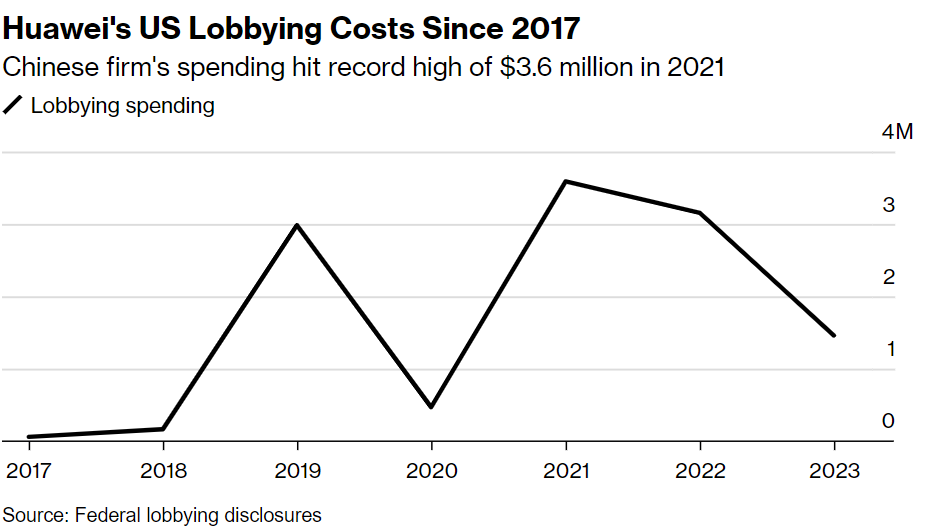

Looking back, during its pinnacle, Huawei boasted a squad of nine lobbying firms and a cadre of public relations representatives at its service. Top-level executives frequently orchestrated briefings with congressional offices and prominent news outlets. Federal filings reveal that the company allocated over US$13 million to lobbying efforts in the last decade alone.

The Chinese wireless equipment maker spent tens of millions of dollars trying to win over US policymakers. Source: Bloomberg

For context, in just one quarter of 2019, Huawei’s spending on federal lobbying skyrocketed to US$1.8 million, marking a six-fold surge from the previous year. The company’s total lobbying expenditure in the US for 2021 amounted to US$3.6 million, per official filings. Some of these funds were allocated to extravagant events attended by prominent figures, including seasoned Democratic lobbyist Tony Podesta, who reportedly earned US$1 million from Huawei that year.

Podesta officially concluded his work for Huawei on December 30, 2022, according to disclosures with the US Senate. “The US market isn’t a likely place for a breakthrough for Huawei in the near future,” Chris Pereira, a former Huawei public relations executive and founder of the consultancy iMpact, told Bloomberg.

With a solid ban in effect and minimal business presence in the US, Huawei has little incentive to continue depleting funds on lobbying efforts in Washington. So much so that the company’s final two registered lobbyists, Jeff Hogg and Donald Morrissey, departed in recent months, as reported by Bloomberg News.

Morrissey, who lobbied for Huawei and Futurewei, confirmed via LinkedIn that he departed the company in December. He now holds the position of senior director of government affairs at the battery technology company Gotion. Hogg, Huawei’s head of government relations since 2020, left the company in November, per his LinkedIn profile. Requests for comment from Hogg went unanswered.

“The lobbyists’ recent departures follow an exodus of staff from Huawei’s US operations and marks a quiet end to the company’s costly, years-long effort to maintain a presence in the North American market. The firm reached its peak by supplying small mobile firms across the US even as major carriers shunned it. Rising tensions with Beijing eventually all but banned it,” the report by Bloomberg reads.

With Huawei ending its lobbying gam, what’s next in the US-China tussle?

As Huawei gracefully bows out of Washington, it marks the end of a chapter in its American aspirations. Yet, the company is far from bereft of alternatives. Responding to the US ban, China’s government decries unfair practices, while Huawei pivots to cultivate its domestic market and spearhead technological advancements. For now, Huawei’s quest to fill the void left by the US market remains uncertain.

The upside is that Huawei is anticipated to shine brightly in the smartphone industry in 2024, and the China-based telco giant is poised for a substantial surge in global shipments, marking a projected double-digit growth. A report from research firm TechInsights recently suggests that the company might emerge as a significant surprise in the overseas market.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications