For the last nine months, there has been a standoff between China’s largest fast-fashion brands, Shein and Temu, in their largest markets – the US. Source: Shutterstock

Shein vs. Temu: The fast fashion war you didn’t notice happening

- The legal dispute between Shein and Temu is undoubtedly not one-sided.

- Amidst the tussle, the US government has its eye on both brands that have been making waves in America.

For the last nine months, there has been a standoff between China’s largest fast-fashion brands, Shein and Temu, in their largest market – the United States. As two of the fastest-growing e-commerce platforms in America, occupying the same off-price shopping space, no one saw the battle coming – or at least for it to escalate to the point it is today.

It all started in December, when Shein sued Temu over intellectual-property infringement. At that point, Temu was just a two-month-old fast-fashion site in the US. Shein specifically accused Temu of misleading consumers into thinking they were the same brand, allegedly selling products copyrighted by Shein and displaying the word “Shein” in search ads that led to Temu’s website.

Shein also claimed that Temu is behind three imposter Twitter accounts using names like “Shein_USA” and asking fans to support “the new Twitter of Shein” while links posted would redirect to Temu’s app and website. Both companies are still fighting over this case in court. Some seven months later, Temu sued its competitor Shein, a dramatic escalation of a contentious legal battle the two fast fashion upstarts have been embroiled in for months.

According to a complaint filed by Temu on July 14 at the District Court of Massachusetts, Shein had allegedly violated antitrust laws, with the former claiming the latter had strong-armed suppliers into exclusivity agreements. Shein forces manufacturers “to sign loyalty oaths certifying that they will not do business with Temu,” reads the complaint.

If they decline, Shein imposes “extrajudicial fines” on the manufacturers and publicly shames them. According to the suit, these alleged antics have led to 10,000 products being pulled from Temu’s site. For Temu, the allegedly strong-arming by Shein is the main problem because only a few manufacturers in China can keep up with the lighting-fast turnaround required by both companies.

Unfortunately, according to the suit, Shein has locked up 8,338 of them into exclusivity agreements. Such exclusivity agreements are illegal under the US antitrust law. It’s also a bad deal for consumers because “Temu beats just about everyone else on price,” the suit claims. Temu is seeking unspecified monetary damages.

The two platforms, rare examples of Chinese tech companies attempting to be mass consumer brands in the US and finding at least some success – despite changeable policies at home and political hostility in the US – are expected to be entangled in the bitter legal war for a while. IThe battle revolves around each accusing the other of illegal conduct to woo American shoppers.

The rise of Shein and Temu in the US

Since its debut in the US in 2017, Shein, founded in Nanjing and headquartered in Singapore, has become the most popular ultra-fast fashion brand, appealing to customers with trendy designs at low prices. The company is valued at about US$100 billion, more than longstanding fast-fashion brands H&M and Zara.

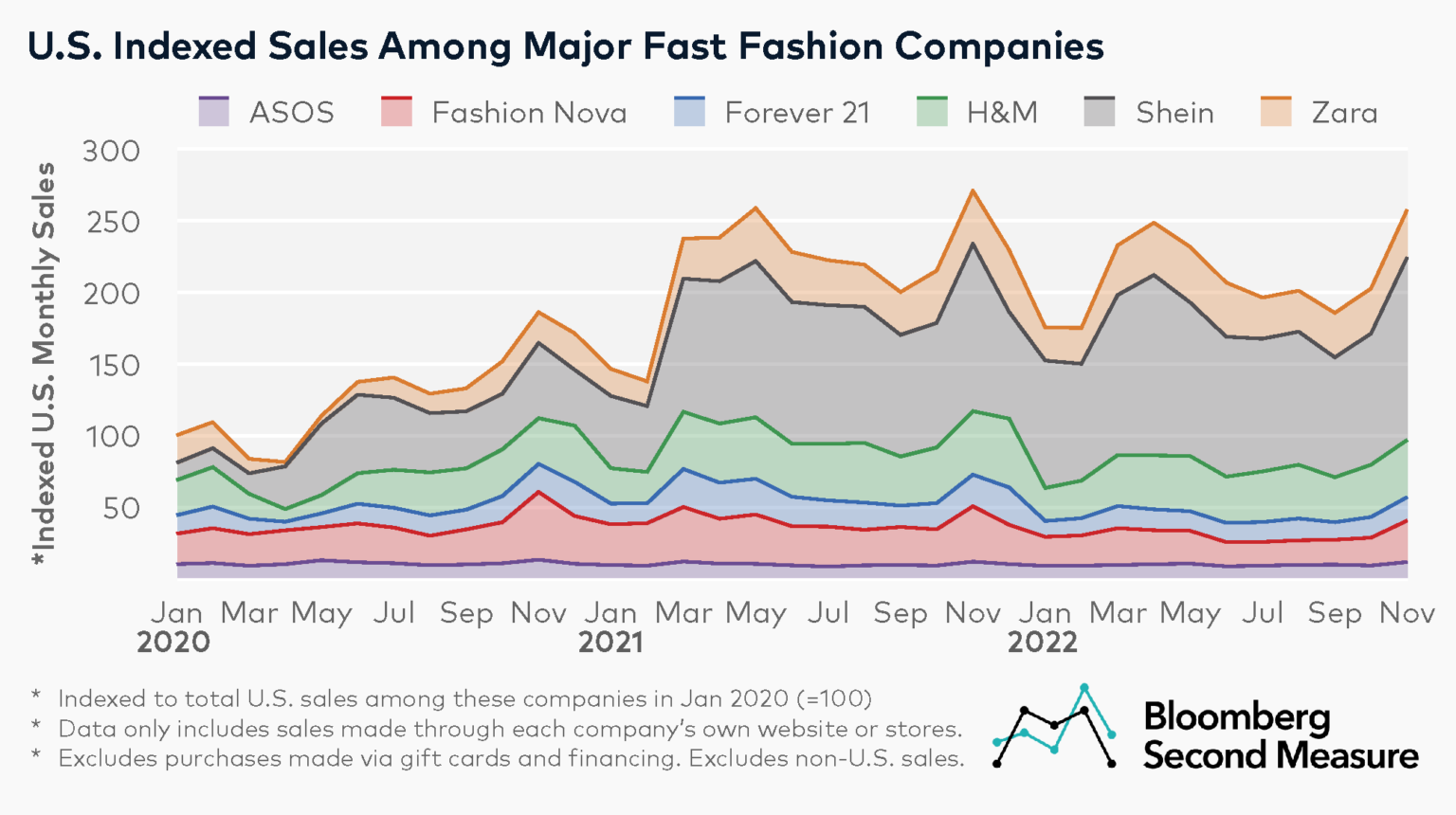

Shein’s growth skyrocketed in early 2020. Source: Bloomberg Second Measure

This year Shein announced it had reached record profit results in the first half of 2023, citing growth driven by the US market. “We recorded the highest first-half net profit in the company’s history, compared to a near break-even during the same period in 2022,” Shein’s executive vice chairman Donald Tang wrote in a memo to investors obtained by CNBC.

Tang highlighted that, in particular, Shein’s continued momentum in the US reinforces its leading position in the market. To recall, other platforms offering cheap Chinese goods failed to reach Shein’s level of influence today. Take AliExpress, for instance; the overseas version of Alibaba, which has been around since 2010, has yet to break through in the US even though it also prices products extremely low.

Shein did things right that AliExpress didn’t—namely, marketing and presentation. Source: Shutterstock

Shein did things that AliExpress didn’t—namely, marketing and presentation. By paying influencers to try out its clothes and produce glossy YouTube and TikTok videos, Shein is spreading the idea that, first and foremost, its products are fun, trendy, and highly affordable. The fact that they’re made in China is secondary.

Shein eventually rose to dominance. According to Bloomberg Second Measure, its market share in the US fast-fashion sales grew from 12% in January 2020 to 50% by November 2022, surpassing big-name competitors such as H&M Group, Zara, ASOS, and Forever 21.

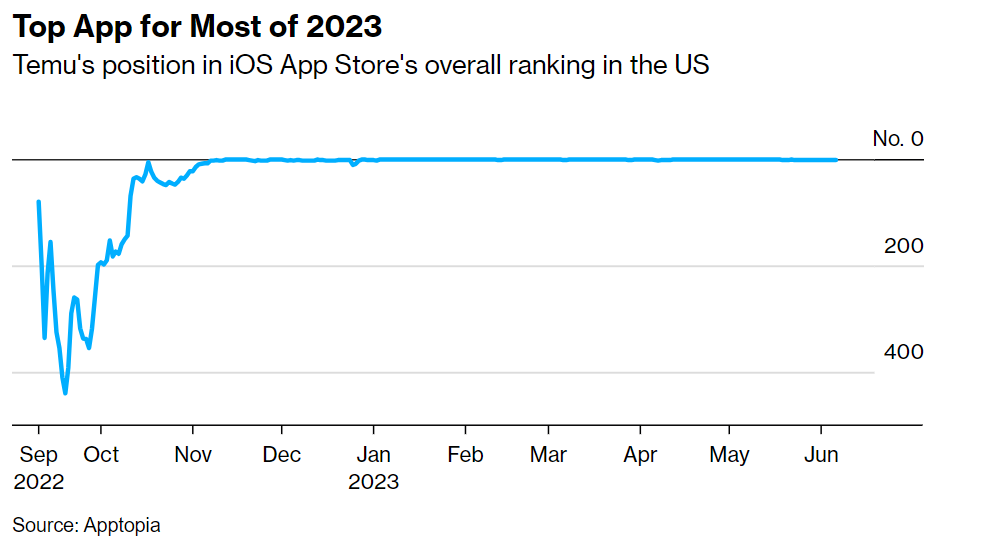

But Shein’s rise is now being threatened by Temu, which launched in the US in September 2022, selling an equally vast assortment of products but marketing itself as an even cheaper alternative to Shein. By the first quarter of 2023, Temu saw downloads jump 57%, topping rankings on both Apple’s App Store and Google Play, according to mobile intelligence firm Sensor Tower.

Temu’s position in iOS App Store’s overall ranking in the US. Source: Apptopia

According to Meta, Temu has run over 1,000 ads on its platforms between September and October 2022, with posts in English and Chinese. In comparison, other rival Chinese apps like Shein and AliExpress have run only dozens of ads. When it comes to app stores, Temu’s iOS ads are primarily targeting consumers in the US and Canada, while its Android ads are also in seven other countries, according to the app-store advertising database App Growing.

The battle of the fittest

In many ways, Temu is attempting to replicate the success of Shein in the US. Both have capitalized on cheap international shipping, China’s strong manufacturing capacity, and the supply chain that Shein pioneered.

To begin with, the companies were distinct for what they sold: Shein did more apparel, while Temu offered household products. But each platform has spilled into each other’s primary product lines, making the companies more direct competitors. In short, they are going after the same expansive network of low-cost suppliers.

So if one platform—especially the more established one—decided to tie the hands of those suppliers, forcing them to choose between the two, one is bound to lose badly – essentially what Temu is accusing Shein of doing. But Temu is no saint, either.

Many Chinese sellers have complained that the platform forces them to accept extremely low prices or arbitrarily ends their business when it finds a cheaper supplier. Frankly, both Shein and Temu’s behavior is not uncommon, especially in China.

Historically, monopolistic practices by internet platforms, such as demanding vendors to transact only on one platform exclusively, or providing differentiated prices to customers based on their shopping history and profiles, have been relatively normal in China. In fact, for years, companies like Meituan and Alibaba’s Taobao forbade vendors from working with competitor platforms until the Chinese government explicitly put a stop to such deals in an antitrust push in 2021.

For Shein and Temu in the US, it remains to be seen how both fast-fashion giants will continue striving without cannibalizing one another in their most prominent market. There are chances for both Shein and Temu to battle with the US federal government, too, because authorities have been highlighting their concerns with Chinese “fast fashion” platforms and the problem they carry.

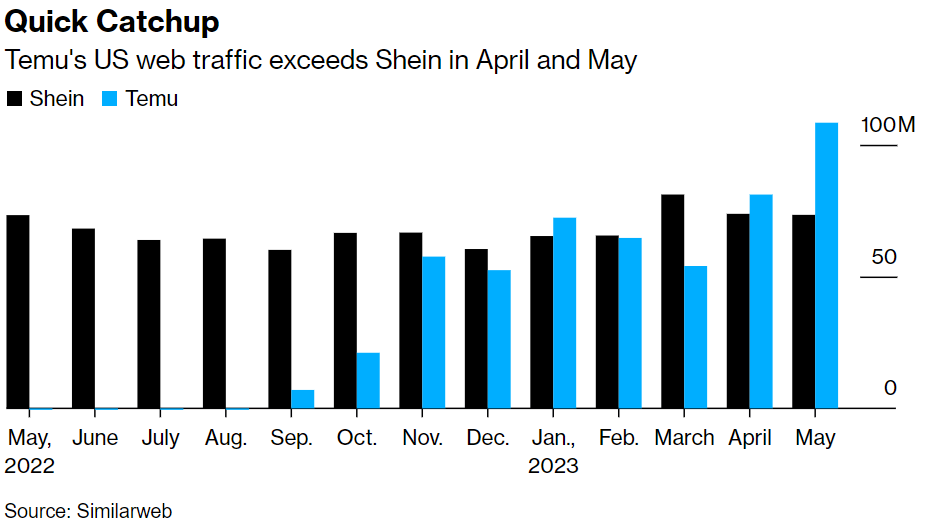

Temu’s US web traffic exceeds Shein in April and May. Source: Similarweb

According to the US-China Economic and Security Review Commission, the challenges posed by platforms like Shein and Temu include:

- The exploitation of trade loopholes.

- Concerns about production processes, sourcing relationships, product safety, and use of forced labor.

- Violations of intellectual property rights.

“The primary focus is first mover Shein, about which the most data is available, with additional discussion of Temu, which has rapidly expanded its US market presence in the past year. These firms’ commercial success has encouraged both established Chinese e-commerce platforms and startups to copy its model, posing risks and challenges to US regulations, laws, and principles of market access,” the commission stated in its brief.

READ MORE

- 3 Steps to Successfully Automate Copilot for Microsoft 365 Implementation

- Trustworthy AI – the Promise of Enterprise-Friendly Generative Machine Learning with Dell and NVIDIA

- Strategies for Democratizing GenAI

- The criticality of endpoint management in cybersecurity and operations

- Ethical AI: The renewed importance of safeguarding data and customer privacy in Generative AI applications